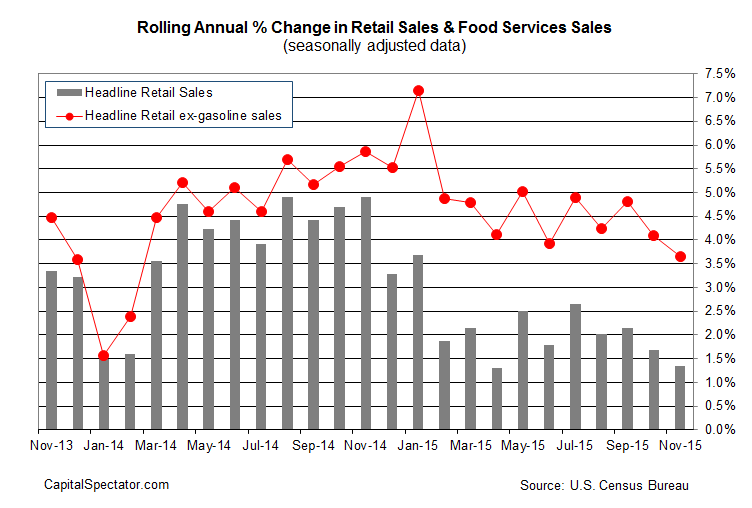

US retail sales rose 0.2% in November, the Census Bureau reports. The increase is a touch higher than the previous month’s 0.1% gain. But the uptick in the monthly data masks the ongoing deceleration in the year-over-year trend. Spending eased to a weak 1.4% annual pace, a seven-month low that’s close to the softest gain since the recession ended in mid-2009. The bad news: it’s no longer about the falling dollar value of gasoline sales due to a bear market in energy.

The yearly rise in retail spending ex-gasoline dipped to 3.7%, the lowest pace of growth in nearly two years. In other words, consumption is trending lower for reasons that appear to be unrelated to falling prices at the pump. That’s a worrisome sign, and a change from previous reports. As long as retail spending ex-gasoline was holding steady at an annual pace there was a case for arguing that the softer headline trend was noise. Unfortunately, today’s report throws cold water on that narrative.

Granted, the recent monthly comparisons point to a pick-up in spending, inspiring some economists to paint an upbeat profile. “Consumers started the holiday season on a pretty solid note,” says Stuart Hoffman, chief economist at PNC Financial Services Group. “It’s a pretty solid across-the-board increase from electronics to apparel to restaurants to online buying.”

Maybe so, but the slide in the year-over-year data suggests that the trend is looking tired. Barry Ritholtz of Ritholtz Wealth Management observed yesterday that “retail looks meh, unless you’re selling cars.”

The slowdown in consumer spending is showing up in other data sets, including personal consumption expenditures (PCE) via the Bureau of Economic Analysis. The annual rate of growth for PCE through October slipped to just 2.9%–the lowest since January 2014. As I discussed last month, however, the fading trend in spending growth appears to be a self-imposed bout of austerity. Note the relatively firm and modestly rising annual trend for disposable personal income (DPI), which edged up to a 4.1% year-over-year increase in October–a nine-month high. A key question now is whether the firm DPI trend will hold up in the November income report that’s due later this month?

As for the big picture, economic growth overall still appears to be slowing. The Atlanta Fed’s GDPNow model projects fourth-quarter growth of just 1.5% (as of Dec. 4), which is below Q3’s 2.1% rise and Q2’s 3.9% surge. That’s not an encouraging sign for spending or income, although there’s still a long way to go for incoming data between now and the end of January, when the government publishes the Q4 GDP report.

Softer retail spending isn’t a pressing concern if economic growth holds up, which is critical for keeping the labor market on a bullish path. The last two updates for nonfarm payrolls suggest that job growth is still running at a healthy rate.

Why, then, are consumers pulling back on spending? The taste for penny-pinching is a bit mysterious with income growth holding firm and payrolls rising at an encouraging clip. The optimistic spin is that consumption will accelerate in the months ahead. The alternative view is that the fading growth trend in retail sales is a sign that the consumer is under more stress than the recent numbers for income and payrolls suggest.