Industrial output fell again last month, slumping 0.2%, the Federal Reserve reports. Output has retreated in seven of the past eight months, marking the longest run of red ink since 2008 for the monthly comparisons of the nation’s industrial activity. The numbers don’t look much better for the year-over-year trend. Production is still rising in annual terms, but at the weakest rate since Dec. 2009, when output declined relative to the year-earlier level.

Today’s release reaffirms that the strong dollar, falling energy prices and softer economic activity in emerging markets continues to take a toll on the US industrial sector. “Manufacturing continues to be kind of soft,” Joshua Shapiro, chief US economist at Maria Fiorini Ramirez Inc., tells Bloomberg. “It’s a combination of weak foreign demand and inventories getting rebalanced. I’d expect another few months of flat-to-down manufacturing output.”

Yesterday’s updates of two regional manufacturing indexes via the Philly and New York Fed banks certainly point to ongoing weakness through October.

Meanwhile, headline retail sales growth was soft last month, although falling energy prices may be exaggerating the weakness, as I discussed on Wednesday. Nonetheless, today’s data on industrial production is a reminder that the US macro trend is wobbly.

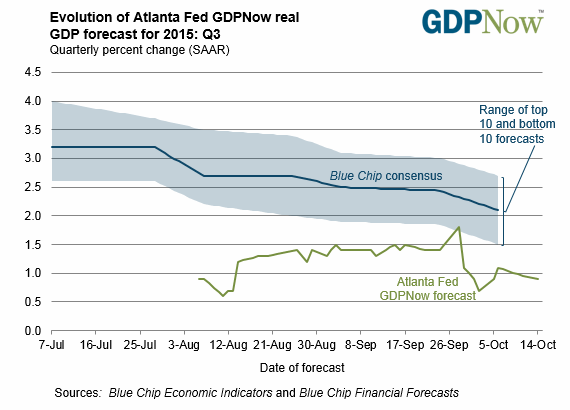

The Atlanta Fed’s GDPNow model (as of Oct. 14) anticipates GDP growth in the third quarter at a tepid 0.9% rate (seasonally adjusted annual terms) for the “advance” estimate that’s due later this month. That’s sharply below the 3.9% rise posted for Q2.

Does today’s weak data for industrial activity confirm that a US recession is fate? No, but the margin of comfort is getting thinner by the month. Despite the recent run of soft figures, the broad trend through last month is still positive overall, based on a diversified mix of indicators. This week’s data takes another bite out of growth, but the downsizing isn’t enough to tip September’s profile into the red (for details, see last week’s update of the US Business Cycle Risk Report).

That leaves us with the question of how October’s data will compare overall? The regional Fed reports strongly suggest that manufacturing will remain weak. Is that enough to trigger an NBER-defined recession for the US? No, at least not based on the numbers in hand, although much depends on how payrolls in October stack up. In particular, will job creation pick up after September’s weak increase? The bullish trend in initial jobless claims suggests as much.

But with gravity still weighing on industrial activity, macro risk remains elevated. Growth still has the upper hand, but the headwinds are strengthening.

Pingback: Industrial Output Fell Last Month