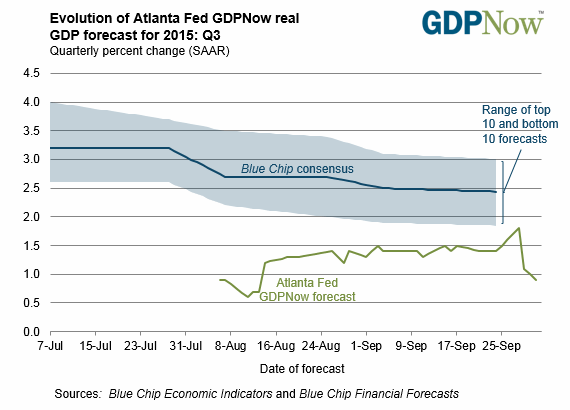

One forecast for a weak US economy in the final months of the year just got weaker. The outlook for third-quarter GDP growth in the US was cut in half today in the widely followed GDPNow algorithm that’s published by the Atlanta Fed. The previous estimate for a 1.8% rise was already tepid–well below Q2’s solid 3.9% advance. But the new forecast for the third quarter quarter that begins today withered even further, slipping to a thin 0.9% (seasonally adjusted annual rate).

“The model’s nowcast for the contribution of net exports to third-quarter real GDP growth fell 0.7 percentage points to -0.9 percentage points on September 29 following the advance report on US international trade in goods from the US Census Bureau,” the Atlanta Fed advises

The sharply lower revision arrives just four weeks ahead the official “advance” estimate from the Bureau of Economic Analysis, which will publish its initial Q3 GDP report on Oct. 29. The question is whether there’s enough time between now and then for upside revisions with the incoming data? Possibly, although time is running short.

Today’s diminished outlook for growth in Q3 is partly a function of the weakness in exports, which is pinching the manufacturing sector. Earlier this week the Commerce Department released its monthly report on US international trade, which “showed that exports of US goods sank a seasonally adjusted 3.2% in August to their lowest level in years,” The Wall Street Journal noted. Jim O’Sullivan, chief US economist at High Frequency Economics, was quoted in the article, saying that “foreign demand remains the weakest part of the economy.” If that wasn’t obvious before, the point is front and center in the wake of today’s dramatic cut in the Atlanta Fed’s Q3 GDP forecast.

But before we decide that all’s lost let’s see how tomorrow’s employment report for September fares. As discussed earlier today, this week’s updates on jobless claims and the ADP Employment Report for September suggest that we’ll see a decent level of growth in the government’s estimate of payrolls that’s due on Friday. Briefing.com’s consensus forecast is projecting that tomorrow’s release will show that American companies added 200,000 workers last month, a strong improvement over August’s weak advance of just 140,000. If the prediction proves to be accurate, perhaps the outlook for Q3 GDP may not be as soft as the GDPNow model is currently projecting.