High-powered voices are calling on the Federal Reserve to delay raising interest rates beyond its policy meeting next week, but it’s not obvious that a stay of execution for squeezing liquidity is a done deal. One reason for thinking that the central bank is still considering the case for pushing rates higher this month: inflation-adjusted money supply continued to contract in year-over-year terms for the third month in a row through August. The slide marks the first run of red ink for base money (M0) in real terms in three years. Meanwhile, the effective Fed funds rate continues to inch higher. These aren’t definitive signs that a rate hike is fate, but on the margins the data supports a hawkish outcome next week.

Real M0 fell 2.6% in August vs. the year-earlier level. That’s the third straight decrease, and the descent picked up speed from July’s 0.7% drop.

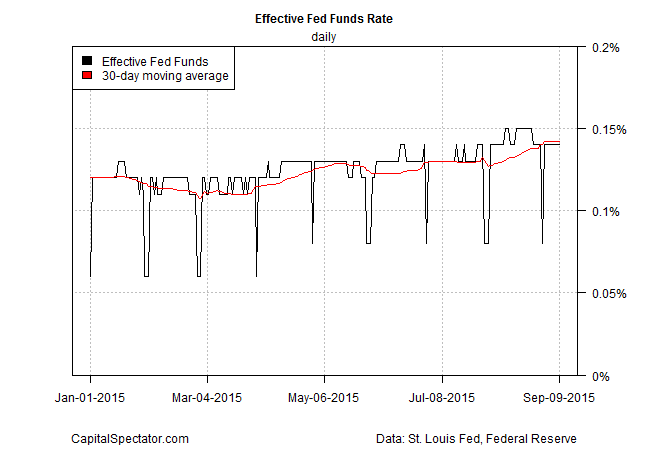

Meanwhile, the effective Fed funds rate continues to drift higher, albeit slowly and at unusually low levels. The change is subtle and this key rate is still virtually nil, which implies that the recent changes could be dismissed as noise. Nonetheless, in the current climate, as the crowd searches for clues on what’s coming, the faint rise in this rate offers a hint for suspecting that the Fed may be laying the groundwork for tightening.

Even if the Fed doesn’t hike next week, the return of red ink to the year-over-year change in the real monetary base deserves close attention. The historical record for this measure of money supply has a close link with the US business cycle, which is why this data is one of several key indicators in the monthly updates of CapitalSpectator.com’s Economic Profile. Is the recent reversal of the trend in monetary liquidity a danger sign? Yes, although it’s still an outlier. Most of the other key indicators are still trending positive, as discussed in last month’s update.

Nonetheless, the tide appears to be in the early stages of turning. The Fed could, of course, reverse itself at any time. It wouldn’t be the first time. In 2013 and 2014, after flirting with a squeeze in liquidity, real M0 surged higher. Is a repeat performance coming? Maybe, but for the moment it appears that we’re moving in the other direction, albeit slowly.

Pingback: 09/11/15 – Friday’s Interest-ing Reads | Compound Interest-ing!

Pingback: Possible Shift in Fed Policy