Yesterday’s ADP estimate on US private payrolls in July was a bit of a disappointment. Companies added 185,000 workers last month—the smallest gain in three months. The news implies that tomorrow’s official jobs report from Washington for July will also reflect softer growth. Is the weaker-than-expected increase a sign that the labor market’s cooling? Maybe, although the latest ISM Non-Manufacturing survey numbers for July suggests that the services sector, the primary source of US employment, is still adding new jobs at a strong pace. In other words, last month’s softer payrolls report via ADP is mostly due to manufacturing—the energy sector in particular, which is reeling from sharply lower commodity prices. The broad trend for US employment, however, continues to look encouraging, courtesy of the upbeat numbers in services.

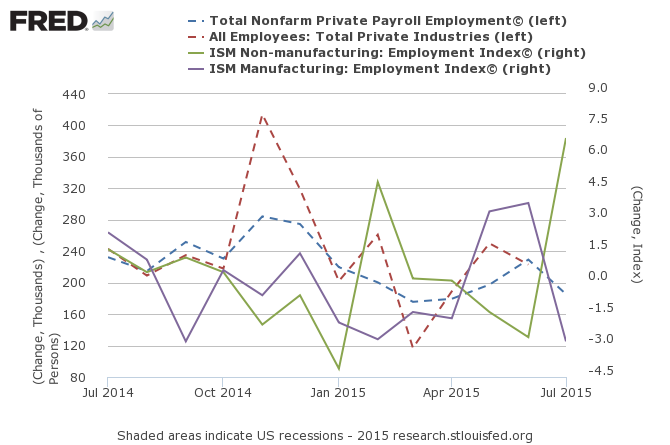

The employment component of the ISM services data surged to 59.6 in July, which is close to a record high for this data set, which begins in 1997. Any reading above 50 reflects growth. By contrast, the ISM manufacturing employment figures slipped to 52.7 last month, down from 55.5 in June. Employment in manufacturing is still expanding, according to ISM, but at a relatively modest rate.

The question is whether the stronger growth in services will offset the weaker trend in manufacturing? That’s a reasonable question when you consider that most of the job growth is bound up with services. In the Labor Department’s June report on payrolls, for instance, more than 99% of the 223,000 rise in private-sector employment was due to services. The monthly share fluctuates, of course, but it’s clear that the overwhelming majority of employment growth in the US–generally 90%-plus–is generated outside the manufacturing sector.

For some perspective on recent history, consider the chart below, which shows the monthly changes for four data sets: private payrolls, based on ADP and Labor Department data (dashed lines, left scale); and ISM’s manufacturing and non-manufacturing employment indexes (solid lines, right scale). Note the strong gain for services employment in July (green line).

The implication is that the broad trend for US jobs remains positive. The headwinds in manufacturing will be a factor. But at this stage it’s reasonable to assume that the lesser pace of growth for payrolls generally isn’t a warning signal for the US business cycle. If and when employment in services stumble, the outlook will change. But at the moment, there’s no sign of trouble when it comes to job creation in the services sector.

The latest ISM data for the services generally “shows a good, solid pace of activity,” Michael Moran, chief economist at Daiwa Capital Markets America, tells Bloomberg. “Consumers are doing fairly well, and housing is starting to do better. We’ve got a good job market in place. We should get stronger results for second-half economic growth.”

As for tomorrow’s July payrolls report from the Labor Department, yesterday’s ADP data implies a relatively softer gain of 186,000, based on the point forecast for a linear regression model. But when we expand the data set to include the ISM employment indexes for manufacturing and services with the ADP numbers, the model’s point forecast for tomorrow’s private-sector jobs report rises to a monthly gain of 223,000–above Econoday.com’s consensus forecast of 210,000.

Predictions should be taken with a grain of salt, of course. In any case, tomorrow’s employment report will provide some perspective for deciding if the robust growth in the services sector will minimize the fallout from manufacturing’s recent slowdown.