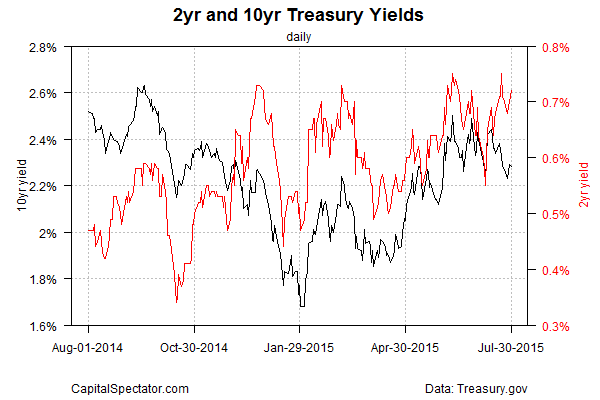

US economic growth rebounded in the second quarter, but the Treasury market isn’t convinced that GDP’s 2.3% advance in the April-through-June period is the catalyst that will bring a rate hike at the Fed’s monetary meeting in September. The benchmark 10-year yield ticked lower yesterday (July 30), settling at 2.28%, according to Treasury.gov data. That’s a touch below Wednesday’s close and well below the recent high of 2.50% that was briefly touched in June.

The outlook for a rate hike may be debatable by way of the 10-year Note, but the possibility of tighter policy looks a bit more likely via the 2-year yield, which is considered the most sensitive spot on the yield curve for rate expectations. The 2-year Treasury inched up two basis points yesterday, reaching 0.72%–close to the recent high of 0.75%.

Overall, the Treasury market is struggling to figure out if a rate hike is imminent. “Moderate growth and a slight firming in inflation don’t provide either side of the rate-hike debate with much ammunition,” writes Joel Naroff at Naroff Economic Advisors.

Reviewing the yield trend by way of exponential moving averages (EMAs) also paints a mixed picture. On the one hand, the 2-year yield continues to signal rising odds of a rate hike in the near term.

By contrast, the 10-year yield’s upward bias of late has softened a bit, as shown by the 50-day EMA’s slight reversal in recent days.

With the Treasury market balanced on a razor’s edge at the moment, next week’s economic updates could be decisive for deciding if we’ll see a rate hike in September. On Monday (August 3) the June numbers on consumer spending and income arrive, along with the July reading of the ISM Manufacturing Index. The main event, of course, is the nonfarm payrolls report for July, due on Friday (August 7).

Meantime, the Treasury market is betwixt and between, waiting for the next shoe to drop, for good or ill. Earlier this week the Fed advised that it “continues to see the risks to the outlook for economic activity and the labor market as nearly balanced.” Using that frame of reference, the critical questions weighing on the crowd: What will shift that delicate balance–and in what direction?