Retail sales revived last month, rising 1.2% in May, according to this morning’s monthly report from the US Census Bureau. The monthly advance represents a substantial improvement over April’s sluggish 0.2% increase. The news provides support for projecting that US economic growth in the second quarter won’t repeat the weak run in Q1.

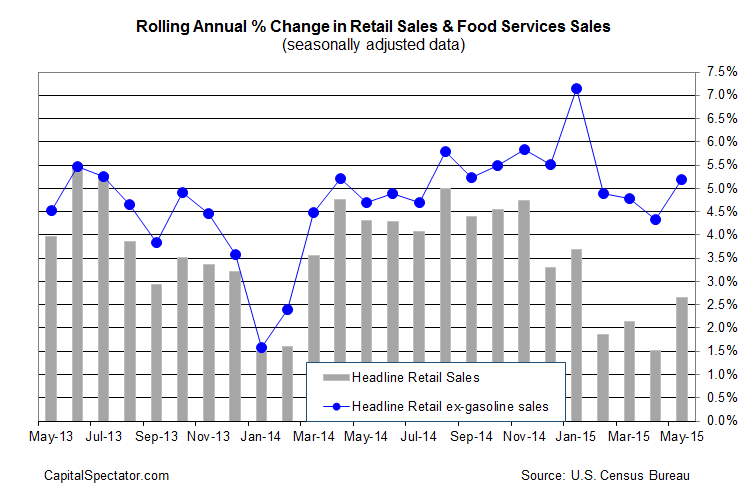

The trend in year-over-year terms looks encouraging as well, with consumption rising 2.7% for the year through last month–a handsome improvement over the previous annual rise of 1.5%. The latest year-over-year advance is still soft relative to recent history, but the healthy directional change is a clue for thinking that consumers may be poised to ramp up spending in the summer.

A more compelling case for a bullish outlook on the retail sector comes by way of stripping out gasoline sales. Retail ex-gas is ahead by a healthy 5.2% for the year through May—the highest annual gain since January.

In fact, using year-over-year retail-ex gas spending as a benchmark suggests that the recent weakness in consumer spending wasn’t all that weak after all. Although this measure of consumption decelerated recently, it remained well above the 4% mark, which implies that spending on Main Street has remained firm all along. Another disappointing report today would have suggested otherwise, but the worst fears of the perma-bears has turned out to be another false alarm.

Indeed, the latest numbers enhance the outlook for growth. When you consider the moderate growth trend for retail sales along with the ongoing expansion in the labor market, the recent speculation in some circles that the US is destined for a new recession in the immediate future continues to look misguided. That’s been The Capital Spectator’s view all along, courtesy of what the data have been telling us, namely: business-cycle risk has remained low (see here and here, for instance).

“The consumer took a month off and came back and spent in style,” observes Ward McCarthy, chief financial economist at Jefferies LLC. “Consumers’ behavior has been inconsistent, but the trend has been for gradual acceleration of spending.”

Pingback: Retail Spending Increases 1.2%