The March report of the Chicago Fed National Activity Index reaffirms what’s been obvious for some time: US economic activity in this year’s first quarter has been soft. It’s premature to interpret the slowdown as anything more than another bump in an otherwise challenged and ongoing recovery. That, at least, seems to be the message via Treasury yields.

There’s a higher level of uncertainty about the strength of the US economy, but the doubt still falls well short of a decisive tipping point… or so Treasury yields imply. If the market was pricing in further macro deterioration for the months ahead, beyond what we’ve already seen in Q1, yields would be tumbling. Instead, interest rates seem to be in a holding pattern. That’s not particularly bullish for the economic outlook, but it’s not quite bearish either.

The next round of economic releases could be and probably will be crucial, of course. The data for April, in particular, will provide key signals for answering the main question: Is the sluggish trend so far this year a prelude to an extended deceleration that moves the economy perilously close to a new recession? Or is the latest stumble a repeat of Q1:2014, when GDP contracted 2.1% only to give way to robust growth for the rest of the year?

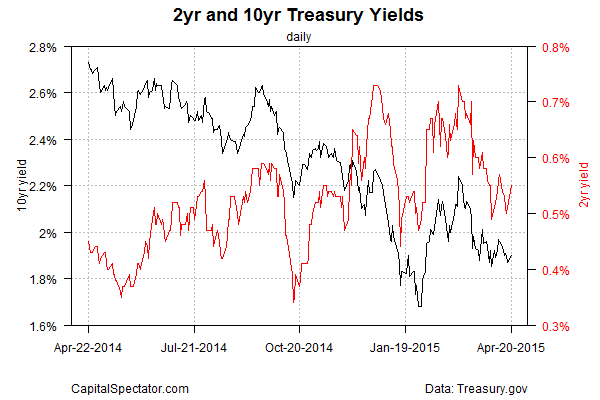

The Treasury market’s leaning toward a neutral stance these days when it comes to looking ahead. The 2-year yield, which is considered to be the most sensitive point on the yield curve for rate expectations, has been treading water this month, bouncing around in the low 0.5% range and settling at 0.55% yesterday (Apr. 20). That’s well below the 0.7% level we saw in March, but it’s telling that the crowd at this point is keeping this yield in a middling range relative to rates we’ve seen so far this year.

The 10-year yield is a bit weaker, but here too it’s not obvious that there’s a decisive downward trend unfolding. Instead, the benchmark Note’s 1.90% rate (Apr. 20) reflects a slightly below-average yield based on the daily data posted so far this year.

Meanwhile, the New York Fed’s Bill Dudley says that the central bank is still moving ahead with the process of monetary tightening. According to The Telegraph:

The Fed has concluded that the abrupt economic slowdown in the first quarter – with growth falling to 1.5% from an average of 2.7% over the past two years – was a temporary blip caused by freezing weather and port disruptions.

Mr Dudley said interest rates in the US should be around 3.5% once inflation returns to 2%.

Hold that thought as you consider the Treasury market’s implied inflation forecast, based on the yield spread via nominal less inflation-indexed rates. The prediction by way of 10-year Notes continues to creep higher, reaching 1.89% yesterday—the highest since last November.

There’s no guarantee that the market will be right. Indeed, history reminds that market-based forecasts are far from flawless, and so the usual caveats apply. But if Mr. Market’s wrong, and the macro data continues to disappoint, the crowd’s headed for a hefty dose of attitude adjustment in the weeks ahead.

Pingback: The Strength of the U.S. Economy Is Uncertain