Residential housing construction rebounded last month, but by less than expected, the US Census Bureau reports. Econoday.com’s consensus view anticipated a strong gain to 1.04 million units in seasonally adjusted annualized terms for March. The actual number turned out to be substantially lower: 926,000. That’s above February’s revised total of 908,000 starts, but mildly so. No wonder that the annual trend for construction remains flat to negative so far this year.

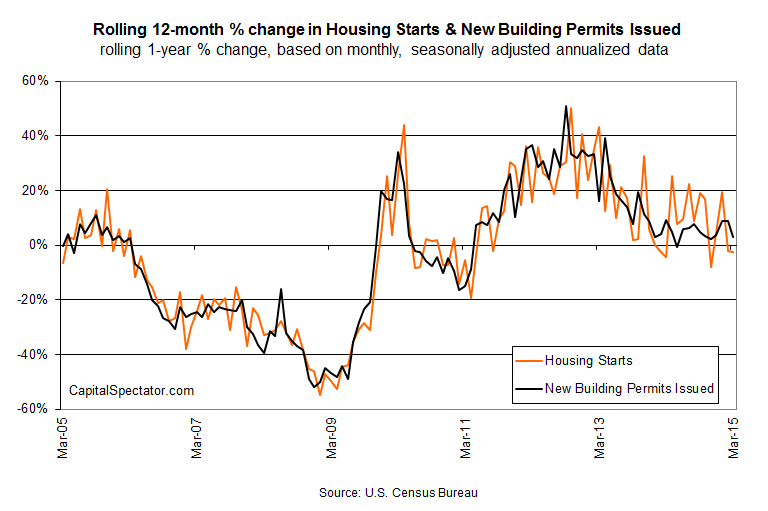

Indeed, both starts and permits are pointing to sluggish growth at best via year-over-year comparisons. Starts declined 2.5% for the year through March, which marks the second straight month of red ink for the one-year change. New permits for housing construction, which is considered a leading indicator for starts, are still rising in annual terms, but just barely. Permits advanced 2.9% last month vs. the year-earlier level, although that’s near the slowest pace in several years and far below the gains in recent history.

But hope springs eternal. “Housing’s not going to come back immediately — that doesn’t mean it’s not going to come back,” advises Lewis Alexander, chief economist at Nomura Securities. “I continue to believe the fundamentals for housing are supportive.”

Home builders seem to agree, based on yesterday’s April survey update of the National Association of Home Builders/Wells Fargo Housing Market Index (HMI), which monitors sentiment in the industry. Builder confidence popped to 56 this month via HMI, a three-month high. “As the spring buying season gets underway, home builders are confident that current low interest rates and continued job growth will draw consumers to the market,” said NAHB Chairman Tom Woods. “The HMI component index measuring future sales expectations rose five points in April to its highest level of the year. This uptick shows builders are feeling optimistic that the housing market will continue to strengthen throughout 2015.”

If so, HMI data is a clue for anticipating a stronger run of numbers–in next month’s update on housing construction? But if there’s a rebound in the works, there’s little sign of it in today’s hard data on last month’s building activity.

Today’s release reaffirms what’s been obvious in recent weeks by way of several economic updates: US economic growth hit a speed bump in the first quarter. The “advance” estimate of Q1 GDP that’s scheduled for publication later this month is on track to confirm what’s already peeking out from several data sets: a substantial round of deceleration in economic activity. The Atlanta Fed’s GDPNow projection for Q1 has fallen to a meager 0.2%, well below the previous quarter’s modest 2.2% rise (inflation-adjusted seasonally adjusted annual rate).

It’s anyone’s guess if we’ll see improvement in the macro profile for April, which will begin to reveal itself in the weeks ahead. Meantime, the first quarter ended with a thud. Most of the key indicators for March have been published and the general message: growth sputtered in this year’s first quarter. The stumble isn’t fatal, at least not yet, in terms of materially raising recession risk (as we’ll see in tomorrow’s monthly update of the US Economic Profile). But it’s clear that the US economy is suffering from headwinds… again.

The question is whether we’ll see a repeat of last year, when Q1:2014 GDP contracted. But it was a head fake: the economy quickly revived, posting strong growth in Q2 and Q3. As for this year’s Q2, we’ll have some preliminary clues in a few weeks, as the April numbers start rolling in. Meantime, the rearview mirror suggests that the US economic revival is on hold once more until further notice.