The US labor market suffered a sharp deceleration in growth in March, but yesterday’s economic releases suggest that last month’s stumble may be a temporary setback rather than the start of deeper troubles that linger. Monday’s updates certainly paint a picture of an economy that’s still expanding at a brisk pace in the services sector, including payrolls.

Services activity represents the dominant source of US economic output. Although this slice of the macro pie alone doesn’t dictate the broad trend, it usually plays a pivotal role. The fact that employment growth ticked higher last month in services is a clue for thinking that the labor market will rebound in the April jobs report.

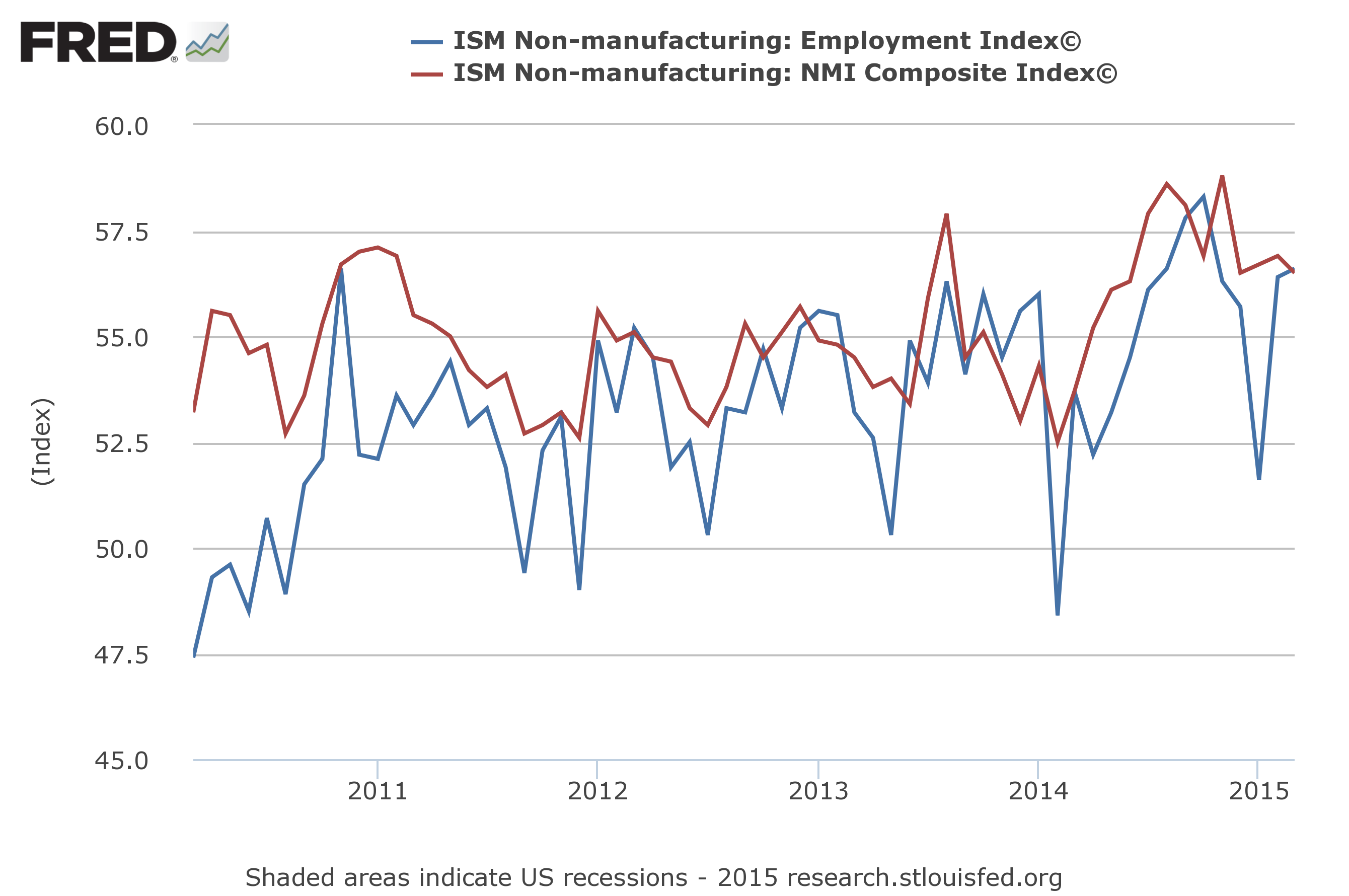

The headline measure for the ISM Non-Manufacturing Index dipped slightly to 56.5 last month, but the latest reading still signals a healthy expansion. Indeed, the index remains well above the neutral 50.0 mark that separates growth from contraction (red line in chart below). Note too that the employment component for services increased in March to 56.6—the highest level since last October (blue line). It’s fair to say that there are minimal signs of stress in the services sector at the moment.

Markit’s purchasing managers index (PMI) for services also delivered upbeat news in yesterday’s update for March. The headline index increased last month, pointing to the “sharpest increase in US service sector output since August 2014.” Meantime, the employment benchmark posted the “strongest upturn in payroll numbers since June 2014,” Markit advised.

If there’s an ominous trend brewing in the US labor market, there’s no sign of it in the services sector. That’s not definitive proof that all is well, but the numbers present a strong clue for thinking that the first-quarter troubles for the US economy may give way to more encouraging news in Q2.

That’s the message in the jobless claims figures in recent weeks. Indeed, last week’s update advised that new filings for unemployment benefits fell sharply at the end of March, near a post-recession low. Here too we have a clue for anticipating a revival in payrolls in the months ahead.

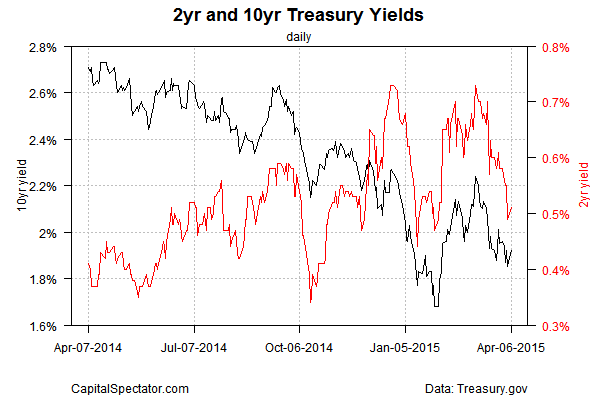

The bond market appears to be considering the potential for a stronger run of numbers. Although the rear-view mirror has recently inspired a flight to safety, yields ticked up yesterday–no small feat given the bearish jobs report on Friday. The rush of optimism that drove yields higher earlier in the year is still MIA, but for the moment Mr. Market is reluctant to cut yields beyond the moderate retreat in recent weeks.

Consider too that the market’s implied inflation forecast (nominal Treasury yields less their inflation-indexed counterparts) are still inching higher. The outlook via the 10-year maturity, for instance, touched 1.85% yesterday (Apr. 6), the highest since early March. True, this market-based estimate of future inflation is still low by recent standards. Yet the upward trend of late suggests that the crowd’s anticipating that moderate growth for the US economy will prevail.

The bottom line: the bond market appears to be having second thoughts about throwing in the towel when it comes to looking ahead. Growth was definitely challenged in the first quarter, and a number of analysts warn that the Q1 GDP report that’s scheduled for release at the end of April will show that the expansion ground to a halt. That’s the message in the Atlanta Fed’s GDPNow data, although here too there’s a glimmer of light. This real-time measure of GDP posted its first rise in the April 2 update in several weeks. The current forecast is still projecting a dismal 0.1% increase for this year’s first-quarter GDP, but perhaps we’ll see more upward revisions between now and the end of April. Unlikely? Maybe, but we have several weeks of yet-to-be published March numbers to review before the “advance” GDP report arrives on Apr. 29.

First-quarter growth probably stumbled, but estimating the degree of the slowdown remains a work in progress. More importantly, it’s not obvious that Q1 troubles are destined to spill over into Q2.

Pingback: Will Q1 Problems Overflow into Q2?

Pingback: 04/07/15 - Tuesday Interest-ing Reads -Compound Interest Rocks