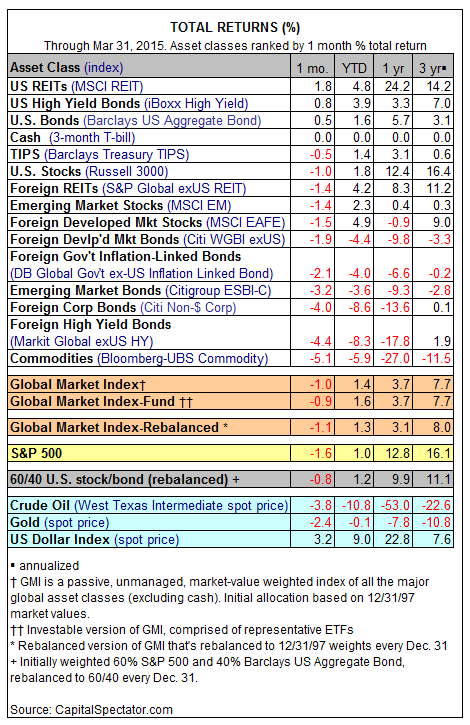

March was a rough month for earning a profit in the global markets. The bulk of the gains (in US dollar terms) in the major asset classes were limited to US bonds and US real estate investment trusts (REITs), which rebounded after a sharp tumble in February. In fact, US REITs (MSCI REIT Index) led the field in March, posting a 1.8% total return. Otherwise, red ink prevailed.

Last month’s biggest loser: broadly defined commodities (Bloomberg-UBS Commodity Index), which slumped 5.1%. The selling pressure also nipped US stocks in March—the Russell 3000 shed 1.0%, paring the year-to-date return to a slim 1.8%.

The bearish bias in March also weighed on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. After a strong rise in February, GMI shed 1.0% in March. For the year through March 31, GMI is ahead by a modest 3.7% on a total return basis. That’s a modest gain relative to what we’ve seen in recent years, although the downsizing of GMI’s performance isn’t surprising. The Capital Spectator’s risk premia projections for GMI have been sliding recently (see last month’s update, for instance). It may be coincidence, but the current trailing one-year gain for GMI now aligns with the implied long-term risk premium forecast of around 4.0%.