What should we expect for tomorrow’s February payrolls report from the US Labor Department? As usual, ADP’s estimate of job creation in the private sector offers a valuable clue. The current forecast based on yesterday’s update: government data will continue to show private payrolls rising above the 200,000 mark for last month, but at a substantially lower increase vs. January’s gain.

The forecast is based on the relationship between the ADP and government data sets. Not surprisingly, there’s a close link between the monthly changes across time. The connection isn’t infallible when it comes to month-to-month predictions; in fact, wide differences between the two arise from time to time. The disconnects are eventually smoothed over, but the occasional bouts of short-term noise are a reminder that predictions for any given month come with a fair amount of risk. So it goes with attempting to divine the future with numbers drawn from the past. Nonetheless, the ADP figures deserve careful attention as a general guide for managing expectations about the official numbers.

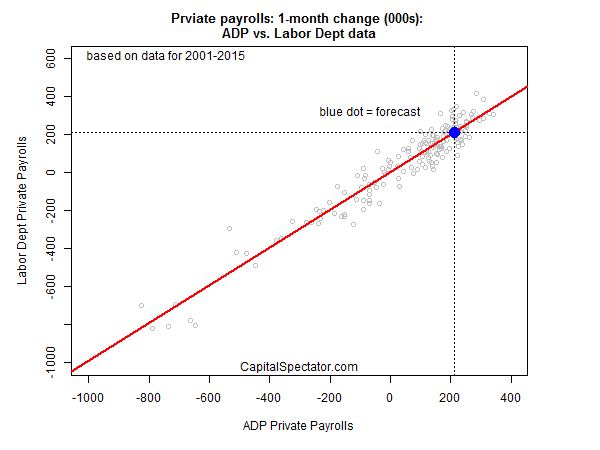

Here’s how the monthly changes in the two measures of private payrolls compare since 2001, the oldest year for the ADP numbers. Based on a linear regression model to predict the monthly change in tomorrow’s private-sector report, the February ADP gain in payrolls (+212,000) implies that the government will report roughly the same increase. If so, the expected rise of 212,000 in tomorrow’s release will mark a lesser rate of growth in the private sector vs. January’s 267,000 advance. An increase of 212,000 is still a decent number, but it’s sufficiently slower to inspire debate about whether the labor market’s recent acceleration is cooling–a topic that will shape discussions about the timing of the Fed’s first interest rate hike.

Keep in mind that the implied point forecast of 212,000 has a wide band of estimates at the 95% confidence level. In other words, the potential for something materially higher or lower is within the realm of statistical probability.

Meantime, the consensus forecast via Briefing.com is anticipating a moderately stronger gain (+230,000) for tomorrow’s private payrolls relative to the point forecast above. Econoday.com survey estimate is slightly lower (+225,000).

The theme that unites all three forecasts is the expectation of a substantially lesser rate of growth for February payrolls vs. the previous month.