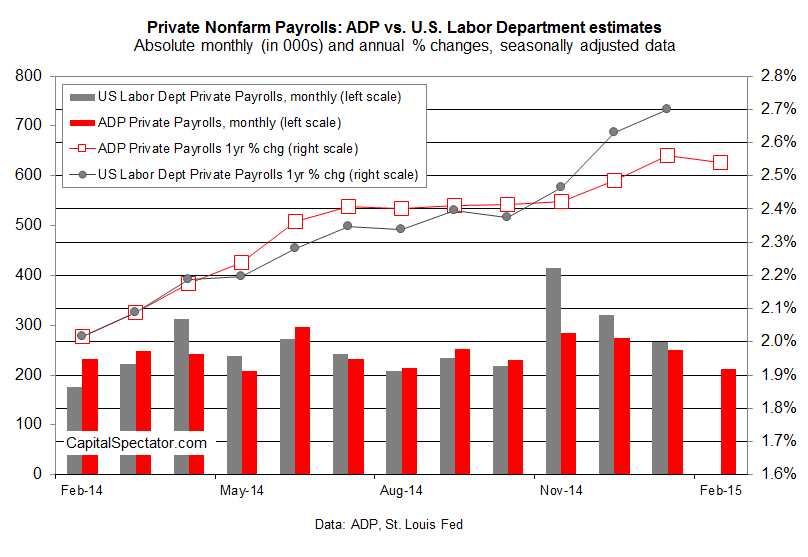

Payrolls at US companies posted another respectable gain in February, advancing 212,000 over the previous month, according to this morning’s update of the ADP Employment Report. The increase is a bit soft relative to the consensus forecast, but the gain still reflects a healthy bias for expansion. Reviewing the numbers in context with recent history, however, shows that the pace of growth is slowing in the private sector. Is that a sign that the US economy’s acceleration of late is fading? Maybe, maybe not—another couple of months will bring deeper clarity. Meantime, there’s a bit more anxiety about the potential risk that the macro trend is slipping back into a familiar pattern in the wake of the Great Recession: sluggish growth.

Yes, it’s premature to assume the worst. In fact, when we look at the trend in the ADP figures the results still look encouraging. The 2.5% annual increase via the estimate of payrolls through last month is close to the strongest gain since the recession ended, exceeded only by January’s slightly faster rise. It’s fair to say that job growth has been substantially stronger than we’ve seen in several years and remains so through today’s release.

But it’s also true that the directional bias has turned downward, albeit mildly so. That’s hardly a reason to panic. The latest run of lesser growth rates could easily turn out to be noise.

At the same time, it’s hard to overlook the fact that today’s ADP numbers arrive after news of wobbly data from other corners of the economy—weak consumer and construction spending in January, for instance. But here too there may be temporary glitches that are gumming up the works—a harsh winter and a dramatic decline in energy prices that have pinched headline spending data.

The usual suspects are inclined to see darkness in the latest releases. They may be right… or not. But let’s not forget that the overwhelming bias in the economic data still points to growth for the near-term future. Recession risk, in other words, remains a low-probability event for the near term—based on the current macro profile via published numbers.

Yet reasonable minds can differ over whether the case for economic acceleration is already waning… again. The next big clue arrives in tomorrow’s weekly update on jobless claims. For those who haven’t been keeping up to date: new filings for unemployment benefits have shown a flat-to-upside bias lately. This too could be just another bout of short-term noise, which isn’t unusual for this volatile leading indicator. When we look at the more reliable year-over-year change for claims there’s still a hefty downside trend in progress, with declines of 10% to 15% posted over the last four updates. That said, if there’s something nasty brewing in the labor market we’ll probably see an early clue in this indicator. Stay tuned.

Meantime, it’s reasonable to wonder if the official payrolls report from Washington due on Friday will also tell us that job growth is slowing. Yes, according to forecasters. The consensus prediction via Econoday.com anticipates a 225,000 increase in private payrolls for February via the Labor Department’s estimate. If that holds up, the news will mark the smallest monthly rise since last October.

Pingback: Payrolls Continue to Gain in February

Pingback: February Payrolls Post a Strong Gain