Industrial output increased sharply in November vs. the previous month, rising at a rate that beat expectations by a wide margin (+1.3% vs. Econoday.com’s consensus forecast of +0.7%) . This morning’s monthly release strengthens the case for expecting that the Federal Reserve will begin raising interest rates next year, perhaps sooner than the mid-2015 forecast that’s been widely cited in recent weeks. Meantime, today’s numbers clearly show that the US economy so far appears to be immune to the economic slowdown that’s weighing on China and the stagnation that continues to afflict the Eurozone. Today’s bullish report on industrial activity follows surprisingly strong November numbers on retail sales and payrolls for the US.

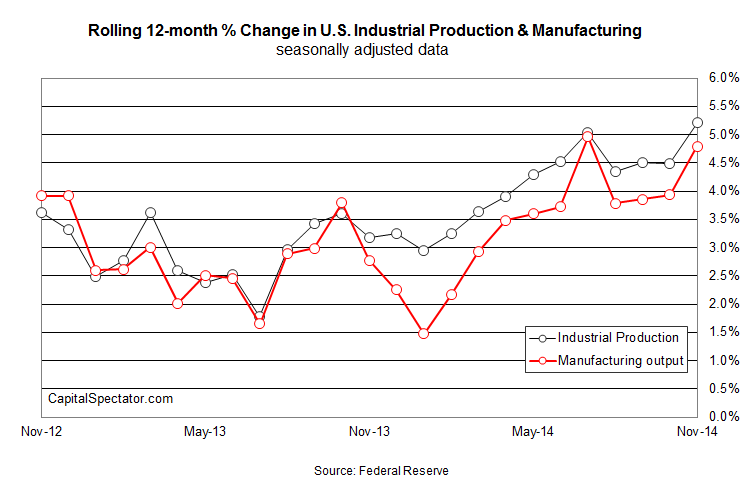

The year-over-year comparison for industrial activity suggests that growth is accelerating. Output increased 5.2% in November vs. the year-earlier level – the best annual gain in nearly four years. The manufacturing component, which constitutes the dominant slice of industrial ouput, delivered strong results as well, including a 4.8% annual increase through last month.

Three solid reports for the November profile so may not be conclusive evidence that the US economy is accelerating, but if this is a head fake it’s one hell of a con job.