US retail spending jumped substantially more than expected last month, the Census Bureau reports: up 0.7% in November vs. the previous month. That’s well above the 0.4% consensus forecast. The profile for consumption looks even stronger on a year-over-year basis. It all adds up to a strong signal for the holiday shopping season, and one that resonates in the wake of last week’s surprisingly potent November advance in nonfarm payrolls.

Stepping back and considering the big picture, today’s release offers another clue for anticipating that economic growth is accelerating. Certainly the November figures so far look encouraging, and then some. At the very least, it’s clear that a moderate pace of expansion has a convincing degree of forward momentum. Accordingly, business cycle risk remains virtually nil at the moment. The softer data elsewhere in the world may throw a wrench into the machine at some point, but for now it’s hard to argue that America’s resilience is being tarnished by foreign imports of malaise or worse.

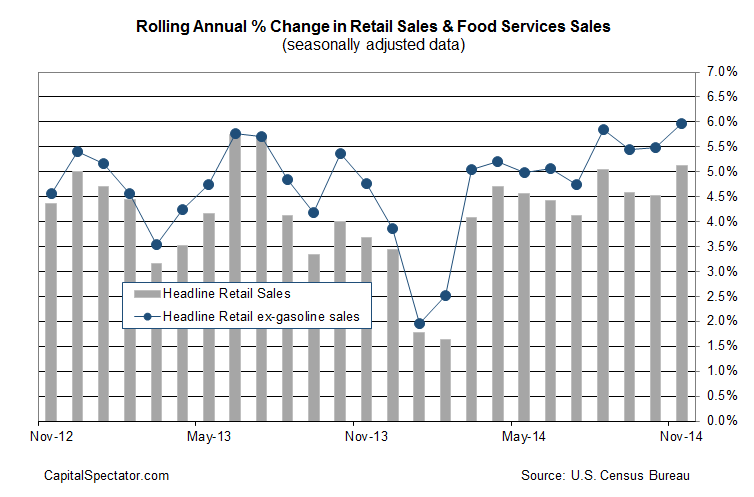

Exhibit A is the fact that the retail trend currently looks stronger than we’ve seen in recent history. Consumer spending in the US climbed 5.1% last month vs. the year-earlier level — the best pace in over a year. Falling gasoline prices only sweeten the deal. Indeed, retail sales ex-gasoline are up a bit more — 6% year over year, the most in nearly three years.

“The consumer is doing pretty well,” observes Thomas Simons, an economist at Jefferies LLC. “Any money consumers are saving from lower gasoline prices is being deployed elsewhere. The broad-based increase in sales is quite encouraging.”

Arguing otherwise requires an unusually virulent strain of pessimism these days.

Pingback: Retail Spending Up in November

Pingback: Thursday links: entrepreneurial energies | Abnormal Returns