This week’s encouraging numbers for the US labor market (jobless claims and ADP’s estimate of private-sector jobs) suggest that today’s official report on payrolls from Washington will deliver upbeat macro news as well. But another round of bullish headlines will weigh on bonds, which have already started to sag.

The current state of affairs is a reversal from the risk-off trade that drove US yields lower last month. But that trade was built on shaky ground as the evidence mounted that the US economy was holding up despite the ongoing troubles in Europe. As it stands now, the market is reversing its preference for holding Treasuries at the expense of risky assets and pushing yields lower in the process. Yes, the US dollar is still the world’s reserve currency, which means that Treasuries will reflect global as well as local perceptions of risk. But it’s getting harder to ignore the US economy’s resilience.

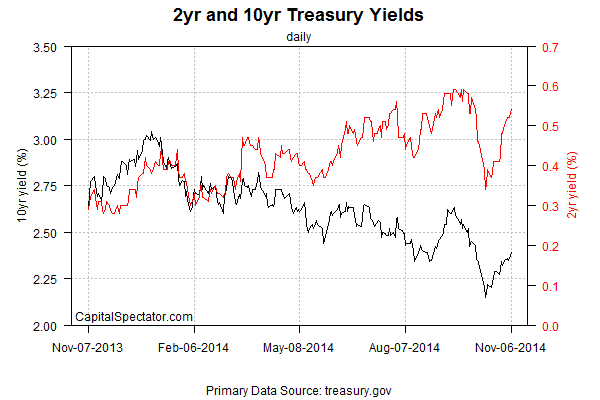

Treasury yields have climbed sharply in recent weeks, with the benchmark 10-year rate rising to 2.39% yesterday (Nov. 6). That’s up from the recent low of 2.15% in mid-October. The 2-year yield, which is considered to be the most sensitive rate in terms of expectations for the Fed’s monetary policy, has moved sharply higher as well, jumping to 0.54% yesterday vs. last month’s low of 0.34%.

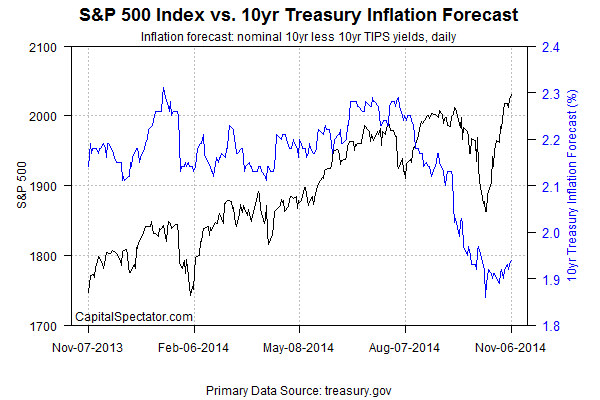

The stock market is certainly reacting positively to the economic news lately. Meantime, the crowd’s starting to raise its inflation forecast, if only slightly, via the implied outlook based on the yield spread for the nominal 10-year Treasury less its inflation-indexed counterpart.

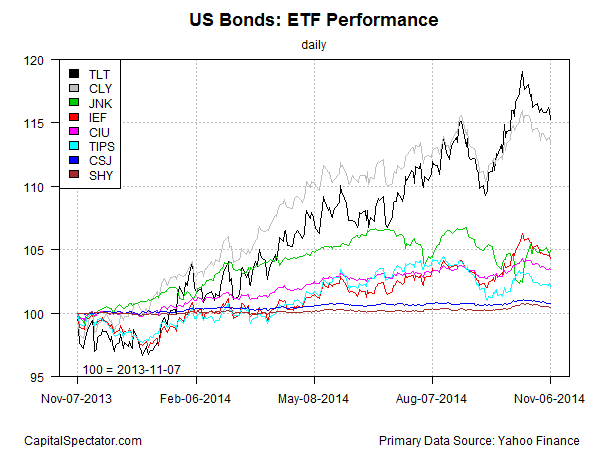

The latest rise in yields is partly a recalibration after last month’s brief but intense rush into safe harbors. If the economic news remains encouraging, rates will probably rise further. If so, the most vulnerable corner of the bond market is at the long end of maturities. Measured by trailing one-year return (252 trading days), ETFs representing long-term Treasuries (TLT) and long-term US corporates (CLY) are currently posting healthy gains. But wtih the US macro profile improving, the strong gains of late are vulnerable. In relative terms, TLT and CLY have enjoyed strong upside momentum lately. Indeed, both funds have soared over the past year vs. the relatively modest gain for AGG, the ETF proxy for a broadly defined benchmark of US investment-grade bonds. (See list below for tickers and links for bond ETFs in the charts that follow).

Here’s another view of how US bond ETFs have fared over the past year. Clearly, long bonds based on TLT have had a good run in recent months, but the tide seems to be turning.

In terms of trailing momentum, long-term Treasuries (TLT) are still an outlier, running well above the 200-day moving average. Even long-term corporates (CLY) pale by comparison.

“The economic data from the United States are pretty good,” says Kim Youngsung, the head of overseas investment for South Korea’s Government Employees Pension Service, via Bloomberg. “There’s not much room for yields to go down.” That’s a simple fact that’s likely to resonate for the foreseeable future, assuming that the incoming macro reports for the US continue to impress the crowd.

* * *

Here’s a list of the sector ETFs cited above, with links to summary pages at Morningstar.com for additional research:

Short Term Treasuries (SHY)

Medium Term Treasuries (IEF)

Long Term Treasuries (TLT)

Short Term Corporates (CSJ)

Medium Term Corporates (CIU)

Long Term Corporates (CLY)