The sharp losses in the stock market lately suggest that the US economy faces a new round of headwinds. Yet there’s no sign of trouble in today’s updates on jobless claims and industrial production. In fact, the numbers du jour delivered substantially better-than-expected results. Taken at face value, today’s data implies that economic growth is accelerating. That’s probably assuming too much at this point, although it’s safe to say that the macro trend still looks encouraging after reviewing this morning’s releases.

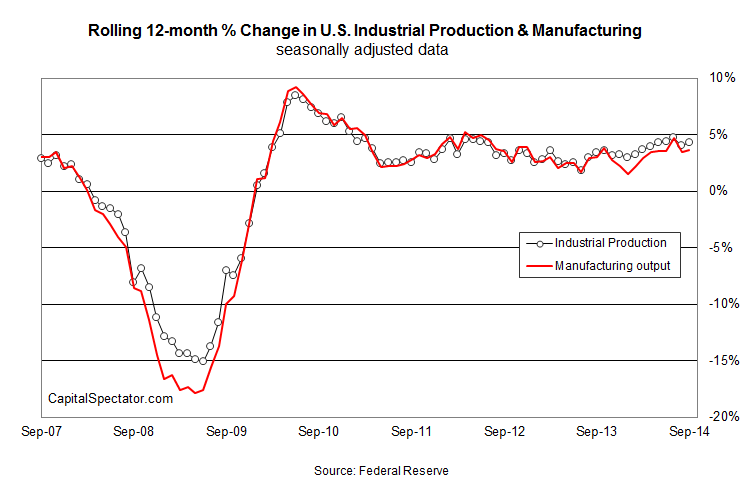

Let’s start with industrial production, which rose a healthy 1.0% in September—more than twice as much as the consensus forecast projected. The manufacturing component didn’t rise as fast, but it still delivered a healthy increase of 0.5% last month vs. August.

More importantly, the year-over-year changes perked up. Industrial output increased 4.3% in September vs. the year-earlier level. That’s up from the 4.0% annual pace through August. Compared with recent history, industrial activity is growing at an annual rate that’s slightly above average relative to the past 12 months.

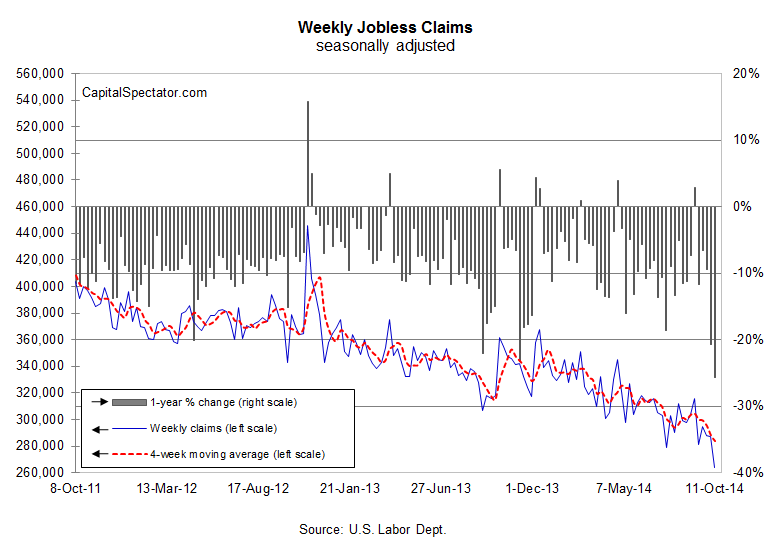

Meanwhile, jobless claims dropped by much more than expected for the week through October 11. The Labor Department advises that new filings tumbled a hefty 23,000 to a seasonally adjusted 264,000—the lowest level since 2000. The news provides a potent clue for expecting that the October payrolls report due out in a few weeks will provide more evidence that the economy continues to mint new jobs at a moderate pace.

The trend looks particularly strong in terms of the annual comparison. Indeed, claims dived by a stellar 26% last week vs. a year ago—the biggest year-over-year decline in four years. To the extent that unemployment filings are a leading indicator, today’s numbers pack a bullish punch for modeling the near-term outlook for payrolls.

The key takeaway from today’s updates: US economic growth endures. The future will likely remain challenged for macro and markets, but primarily for reasons beyond America’s shores.

What’s the downside? Today’s news is so good that it’s likely to fire up the conspiracy theorists who’ll argue that the government’s cooking the books. But assuming that the numbers are legitimate, which is my working assumption, today’s reports tell us that the recovery is in no danger of slipping over to the dark side for the foreseeable future.

Pingback: Wall Street National | Repricing US Treasuries For Eurozone Deflation - Wall Street National