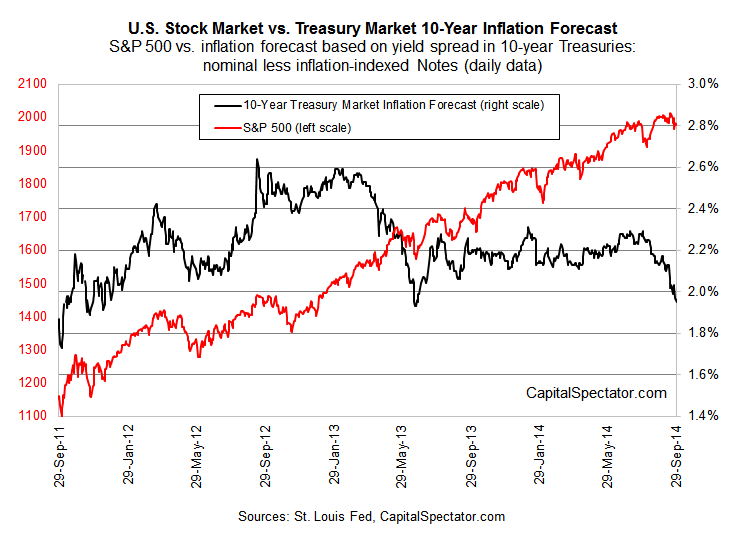

The Treasury market’s inflation forecast via 10-year Notes continues to fall and the US stock market has turned wobbly too. That’s a troubling combination… if it continues. The antidote to this mini re-run of heightened disinflation risk is economic growth. This week’s updates on payrolls will stress test the case for expecting moderate growth to roll on, starting with tomorrow’s estimate on private-sector jobs for September via ADP, followed by Friday’s official numbers from the Labor Department. Meantime, Mr. Market is downsizing his outlook for inflation. The yield spread on the nominal 10-year Note less its inflation-indexed counterpart slipped to 1.95% yesterday (Sep. 29)—the lowest in more than a year.

The downward bias in inflation expectations has been in force for a month, although it’s debatable if this is due to worries about the US economy vs. deteriorating conditions in the Eurozone and elsewhere. The US dollar, of course, is still the world’s reserve currency and so it’s not unusual for global investors to pile into greenbacks when there’s a rising appetite for a safe haven around the world. Nonetheless, the sight of persistently falling inflation expectations is striking. If the trend is accompanied by weak numbers on payrolls later this week, the crowd’s anxiety level is sure to rise when it comes to thinking about the US macro outlook.

For the moment, however, it’s reasonable to assume that offshore demand for Treasuries is the primary driver of lower US yields of late. Earlier today, Eurostat reported that year-over-year inflation in the Eurozone slipped to a five-year low of just 0.3% for September. Deflation risk, in other words, remains a real and present danger. That’s a serious problem when you consider that the Eurozone economy was stagnant in the second quarter and more of the same is expected for Q3.

The US, by contrast, still looks relatively strong. Second-quarter GDP jumped 4.6% and inflation has been relatively stable at around 2%. The question is whether the current stumble in inflation expectations via Treasuries has any relevance for the US outlook? Or is the slide mostly a risk-off import? We’ll be in better shape to answer intelligently after reviewing this week’s September numbers for US payrolls.