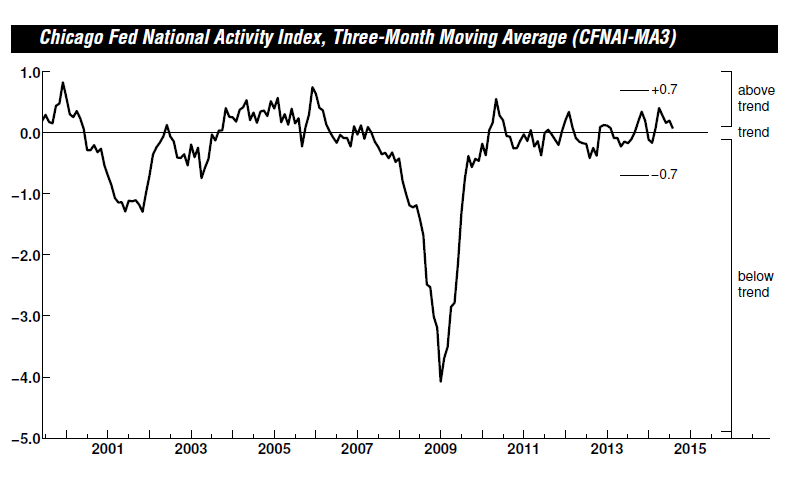

US economic activity decelerated more than expected in August, according to this morning’s update of the Chicago Fed National Activity Index. The three-month average for the business cycle benchmark (CFNAI-MA3) declined to +0.07 for last month’s reading vs. a revised +0.20 for July. The latest figures still reflect an “above-trend” pace of growth for the world’s biggest economy, according to the Chicago Fed. Nonetheless, today’s release raises more doubts about the recent assumption that the US economy is accelerating.

The outlook for ongoing but unspectacular growth also finds support in today’s Q3:2014 GDP nowcast for the US. Although the risk of a new recession is still low, as detailed in last week’s US Economic Profile at CapitalSpectator.com, the macro trend doesn’t look poised to break free of the modest pace that’s prevailed in recent years.

As such, one might wonder how, or if, recent numbers about the economy’s outlook will influence expectations for the Fed’s plans to start raising interest rates next year. On that note, it’s interesting that the central bank trimmed its projections for GDP in last week’s revised set of economic estimates. For instance, the Fed’s central tendency for its prediction of GDP growth this year ticked down to a 2.0%-to-2.2% range in the projections published on September 17—a touch lower from the 2.1%-to-2.3% range in the June release. For next year, the Fed’s downward revision is slightly more pronounced: GDP growth is now expected to be in the 2.6%-to-3.0% range for 2015, which is below the June prediction of 3.0%-to-3.2%.

Incoming data could alter the outlook, of course, starting with tomorrow’s flash estimate of Markit’s purchasing managers index (PMI) for manufacturing in September. The report offers an early look at this month’s macro profile, which is mostly a mystery at this stage until the September numbers start arriving in the weeks to come. Meantime, the consensus forecast for tomorrow’s PMI data sees the benchmark inching higher: to 58.1 for September vs. last month’s 58.0, according to Econoday.com. If the forecast holds, manufacturing activity will still be expanding at the fastest pace in more than four years, based on Markit’s data.

One index for manufacturing is hardly the last word on evaluating the US economy. That said, a fresh set of numbers that reconfirm the robust expansion for this sector will boost confidence for thinking that last month’s deceleration via CFNAI-MA3 isn’t a prelude to an autumn that brings stronger headwinds.