When the dust clears from tomorrow’s Fed announcement, the crowd’s expecting that the slow but persistent pace of tapering will endure. While we’re waiting for Wednesday’s monetary statement, revised set of economic projections, and press conference, consider that the real (inflation-adjusted) year-over-year increase in the monetary base continues to decelerate. That’s not surprising at this point, but it’s a clear signal that monetary stimulus is still moving closer to normalization.

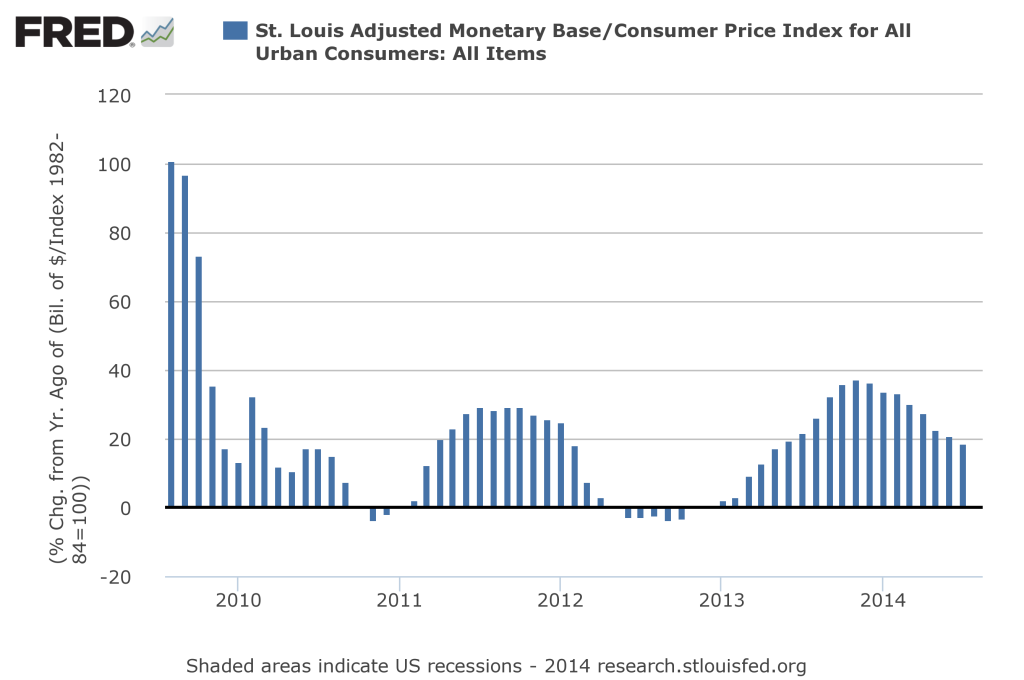

Base money in real terms increased 18.7% in July from a year ago, the slowest growth rate since May 2013. Since peaking last November at 37.2%, the inflation-adjusted year-over-year growth for the St. Louis Fed’s estimate of base money has been steadily falling. The weekly data through September 3 reflect a similar trend of deceleration.

Deciding what comes next is tricky, in part because a period of turbulence in macro and markets followed after the Fed ended previous phases of quantitative easing (QE). The economy is stronger these days and so there’s a good case for arguing that winding down the current installment of QE will be smoother this time. Nonetheless, some analysts think that the taper won’t be painless.

“It’s happening again, but in slow motion, because the QE3 taper was gradual and from a higher level,” says James Rickard, author of The Death of Money: The Coming Collapse of the International Monetary System. “When this third taper is done in November, the weakness will become apparent.”

Maybe, although the data at the moment don’t align with a pessimistic view. True, the August reports on industrial production and payrolls delivered unexpectedly weak numbers, but those figures look like noise when considering a broader spectrum of indicators. Keep in mind too that industrial output, even after the latest batch of data, is still advancing at a moderate 4.1% annual rate—near the best pace we’ve seen since the recession ended in 2009. Meantime, private payrolls continue to rise at 2%-plus a year through August, which is more or less the rate of increase in recent history.

But the case for arguing that economic growth is accelerating is weak, at least based on the numbers of late. But it’s also quite speculative to argue that the macro trend is stumbling. Europe’s troubles and China’s latest slowdown may challenge this view in the months ahead. But for now, a familiar narrative dominates when you dig into the numbers for the US: moderate growth. That trend implies that the Fed will maintain a slow pace of tapering. If the incoming data in the weeks and months ahead are softer than expected, the central bank may be forced to revise its strategy. But for now the Fed’s still on track to end QE and start raising interest rates at some point next year.

Yes, the transition could be bumpy, but that’s probably unavoidable. Waiting for the US economy to roar back to life a la the pre-2008 era is asking for too much at this stage. There’s a reasonable if controversial argument that US growth will remain constrained for some time (see this analysis by economist James Hamilton for a summary). As for the immediate future, however, expecting moderate growth to roll on remains a realistic assumption.

Pingback: FOMC Meeting Expected to Bring Continued Tapering