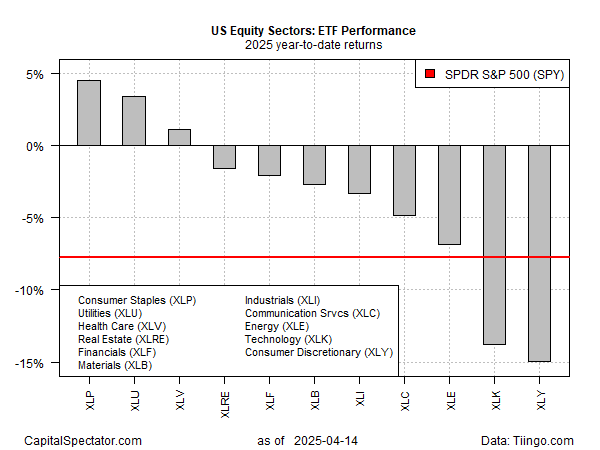

US stocks have taken a hit this year, but the pain – as usual – varies widely by sector. The spread between the best and the worst performing sectors year to date has widened sharply to more than 19 percentage points, based on a set of ETFs through Monday’s close (Apr. 14).

Leading the winners this year: consumer staples stocks (XLP), rising 4.5% year to date. Utilities (XLU) are a strong second-place performer with a 3.4% gain so far in 2025. The broad US stock market (SPY), by comparison, is down 7.7% this year.

The biggest loser, by far: consumer discretionary (XLY), which has fallen 15.0%, or twice as much as the stock market overall.

Burnishing their defensive bona fides, consumer staples (XLP) and utilities (XLU) have remained in positive terrain for much of the year so far, despite the spike in overall market turbulence. But the real test may lie ahead after the S&P 500 Index triggered a bearish warning yesterday via a widely followed technical indicator.

The arrival of the so called death cross on Monday – S&P 500’s 50-day average falling below its 200-day average – is considered a risk-off signal by some analysts. But like all trading signals, its track record is mixed.

“It’s a very ominous sounding signal in equity markets, but when you actually back-test the death cross throughout history, you’re better off a buyer than a seller on the death cross,” said Adam Turnquist, chief technical strategist for LPL Financial.

Meanwhile, memories of the previous death cross are lurking. In mid-March 2022, this indicator shifted to a risk-off position. Seven months later, the S&P 500 bottomed and started rebounding – a bull run that ended two months ago, when the market peaked at a record high.

“While every major decline starts with a ‘death cross’ not every ‘death cross’ leads to a major decline,” Ari Wald, head of technical analysis at Oppenheimer & Co., told Business Insider recently.