The appetite for risk has taken a hit in recent weeks, although the worst of the selling has, so far, been contained to US stocks, on a year-to-date basis. The rest of the primary markets around the world, by contrast, are still posting gains so far in 2025, based on a set of ETFs through Friday’s close (Mar. 14). The relative strength in markets outside the US has helped global asset allocation strategies remain relatively resilient. But with the mood souring due to the rising risk of a global trade war, confidence about the near-term future is vulnerable.

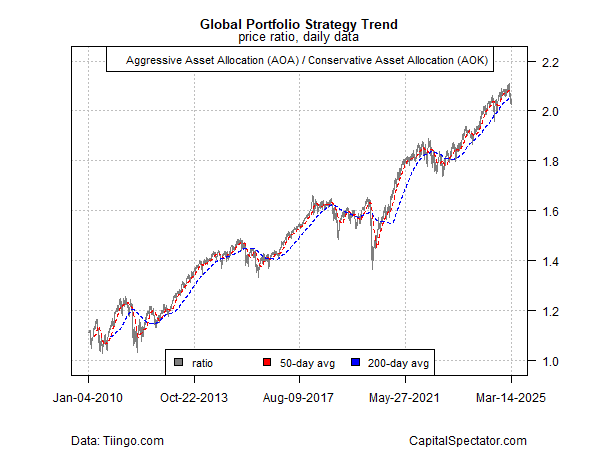

For some perspective on where the pressure is building, let’s start with a big-picture review of an aggressive posture for global asset allocation vs. its conservative counterpart, based on ETF proxies. The risk-on sentiment by this measure has clearly taken a hit lately, with the ratio sliding decisively below its 200-day moving average for the first time since last September. But the near-term strength of the risk-on signal is open for debate for this top-down strategy as long as the 50-day average for the ratio remains above its 200-day average, as it still does.

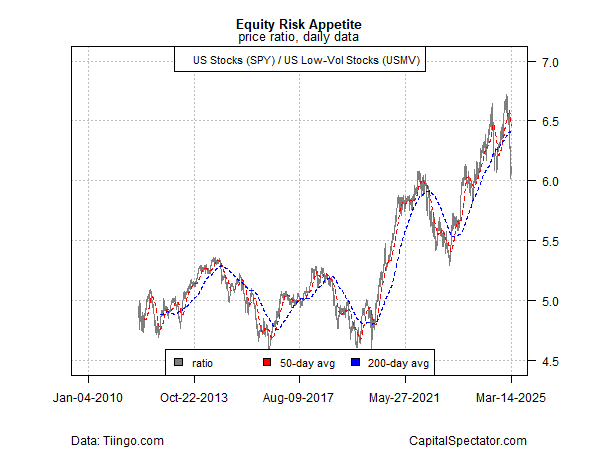

By contrast, the US equities space has deteriorated sharply, based on the ratio for a broad measure of stocks (SPY) vs. a low-volatility counterparty (USMV). Based on this ratio, the full-out risk-off signal is approaching fast unless the market stabilizes soon.

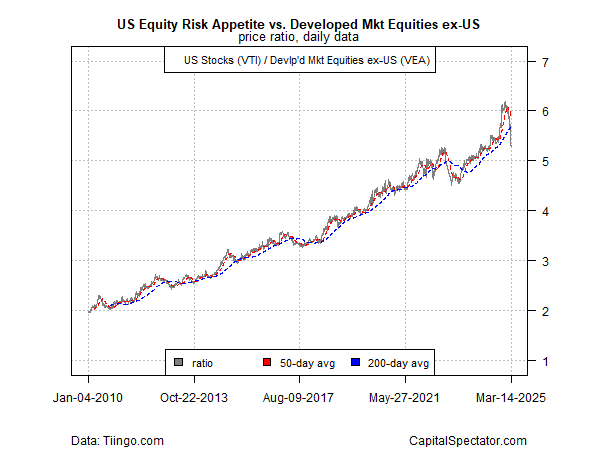

The comparison between US stocks (VTI) and equities in foreign developed markets (VEA) has also suffered an unusually sharp and sudden reversal of fortunes.

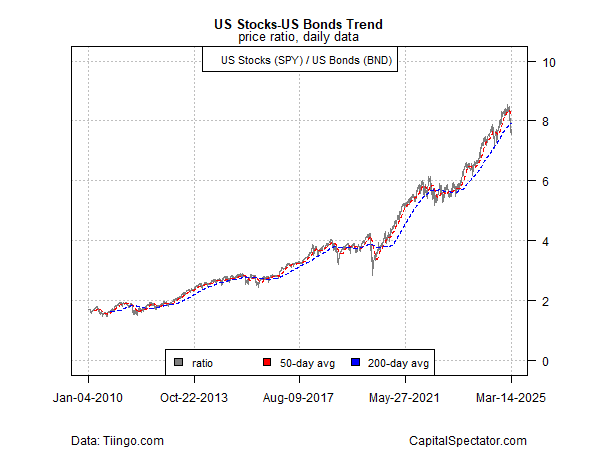

There’s been a similarly dramatic change recently for US stocks (SPY) vs. US bonds (BND) recently as demand for safe havens has shot up lately.

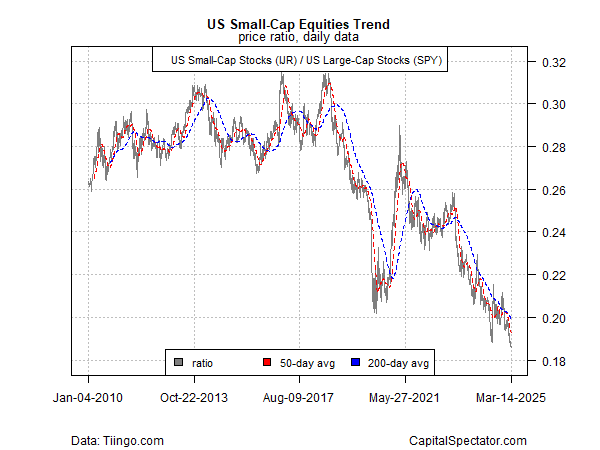

One relationship that hasn’t changed lately: weak relative strength in US small-cap stocks (IJR) vs. their large-cap brethren (SPY). Although renewed optimism for small-cap shares periodically arises, the ratio for small caps vs. large caps continues to show that the trend remains negative lesser-sized firms. To state the obvious: the current concerns are driving small-cap sentiment to a deeper shade of red.

Deciding if the current pullback in risk sentiment is temporary or the start of extended slide will depend on how the global macro profile evolves. At the moment, tariff risk is weighing on expectations, and so much depends on the path ahead for decisions on trade relations between the US and the rest of the world.

Meantime, the outlook is skewed to the downside. The OECD today, for example, lowered its forecast for global economic growth in 2025 and 2026. “A series of recently announced trade policy measures will have implications for the economic outlook if sustained,” the OECD said. Until there’s more clarity on the “if” part of the analysis, the case for a defensive posture will continue to resonate.