The US stock market fell on Thursday, Mar. 13, closing 10.1% below its previous peak – a decline that many analysts define as a “correction,” which is a slide ranging from 10% to 20%. A “bear market,” according to Wall Street-speak, arrives when a decline exceeds 20%. The “B” word doesn’t apply, at least not yet, but stocks are clearly on the defensive. Yet some corners of global markets are holding up if not rallying. Here’s a quick review that highlights a select list of recent winners, based on a set of ETFs through yesterday’s close.

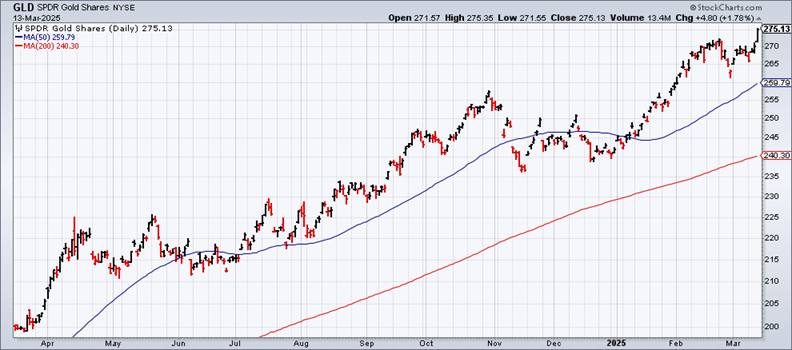

A leading bright spot at the moment is gold (GLD), which continues to rally; the metal set a new record high yesterday. “Amid escalating geopolitical tensions, rising trade tariffs, and growing financial market uncertainty, investors are increasingly seeking stability – and they are finding it in gold,” said Alexander Zumpfe, a precious metals trader at Heraeus Metals Germany.

Short-term US Treasuries are also resilient in the current climate. The iShares 1-3 Year Treasury Bond ETF (SHY) closed up yesterday, trading near a record high.

Certain portfolio strategies are also looking strong this year. One bullish standout is merger arbitrage. The recent uptrend for the IQ Merger Arbitrage ETF (MNA) has been a port in a storm this year.

Some versions of broadly defined commodities portfolio are also posting relative strength in 2025. The WisdomTree Commodity Index (GCC) is up 2.7% year to date despite a recent setback.

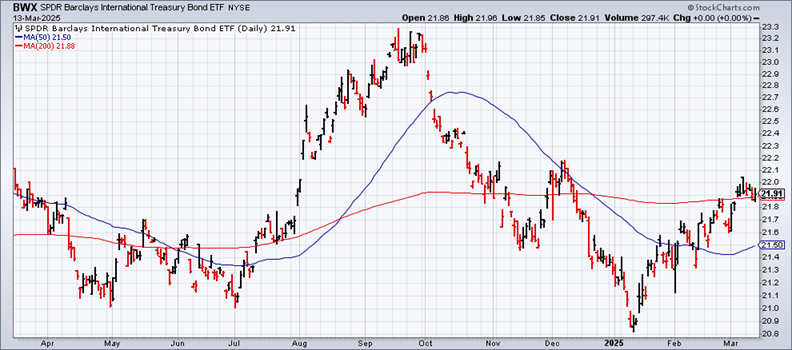

Prices for foreign government bonds have been rising lately from a US-investor perspective, in part due to a weak US dollar this year. When the greenback falls, that’s usually a tailwind for foreign assets denominated in foreign currencies. The bullish effect is conspicuous in government bonds issued in developed markets ex-US (BWX).

Government bonds issued in emerging markets (EMLC) are posting even stronger results in 2025.

Back in the US, stocks in the utilities sector (XLU) have traditionally been a safe haven and there’s some evidence for maintaining that view amid the latest correction for stocks overall. Utilities have been relatively stable this year and are currently posting a 2.2% advance for 2025 through yesterday’s close.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno