US jobless claims rose more than expected last week, rising to highest level since December. Although the rise leaves claims far below a level that suggests elevated recession risk, some economists see the increase as a sign that the labor market is slowing.

China’s Ministry of Commerce today said it “firmly opposes” President Donald Trump’s latest threat to raise tariffs on Chinese goods and vowed retaliation, if necessary. “If the U.S. insists on its own way, China will take all necessary countermeasures to defend its legitimate rights and interests,” a Ministry of Commerce spokesperson said in a statement

Uncertainty is starting to weigh on the economic outlook, advises an economist at the conservative American Enterprise Institute. “There’s more uncertainty than I think is widely appreciated,” said Michael Strain. “All the uncertainty around trade policy, uncertainty around some of the things that the Department of Government Efficiency is doing, I think will have a chilling effect on investment plans and expansion plans.”

US durable goods orders rebounded more than expected in January. Driven by a strong increase in orders for transportation equipment, durable goods orders rose 3.1% after tumbling by a revised 1.8% in December.

Pending home sales in the US fell to a record low in January. “It is unclear if the coldest January in 25 years contributed to fewer buyers in the market, and if so, expect greater sales activity in upcoming months,” said Lawrence Yun, the National Association of Realtors’ chief economist. “However, it’s evident that elevated home prices and higher mortgage rates strained affordability.”

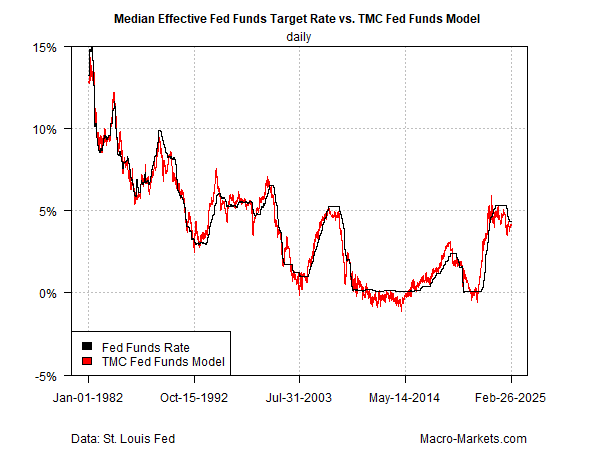

Fed expected to keep interest rates steady at the upcoming March 19 policy meeting despite inflation concerns, reports a note by TMC Research, a unit of The Milwaukee Company, a wealth manager. “For the past two weeks, the Fed funds rate has maintained a small spread over TMC Research’s model estimate of roughly 20 basis points or less – the smallest gap in more than a year. The low spread suggests that the Fed still has a basis for leaving interest rates unchanged at next month’s policy meeting.”