The central bank’s job is never easier, but in the current climate it’s unusually tricky.

In addition to the usual challenges that complicate real-time monetary-policy decisions, the Federal Reserve must weigh the potential economic implications from a blizzard of edicts from the White House. It’s unclear how President Trump’s plans have altered the Fed’s expectations, but private sector economists are weighing in on the outlook.

Torsten Sløk, Apollo’s chief economist, notes that while the incoming US economic data remains strong, “we are starting to worry about the downside risks to the economy and markets from: 1) the impact of DOGE layoffs and contract cuts on jobless claims and 2) persistently elevated policy uncertainty weighing on capex spending decisions and hiring decisions.”

Stephanie Roth, chief economist at Wolfe Research, is less concerned that the widespread terminations of federal employees that appear to be DOGE’s objective will take a serious bite out of growth. “It’s not going to tip the economy into recession by itself,” she advises.

Meanwhile, President Trump yesterday reaffirmed that he plans to push ahead with tariffs on Canada and Mexico next week. “The tariffs are going forward on time, on schedule.”

The potential a tariffs-related boost in inflation, if only temporarily, remains a possibility. It’s open for debate how the Fed will respond, or if it will respond, but for the moment the central bank is expected to leave its target rate unchanged at the next FOMC meeting on Mar. 19, based on Fed funds futures.

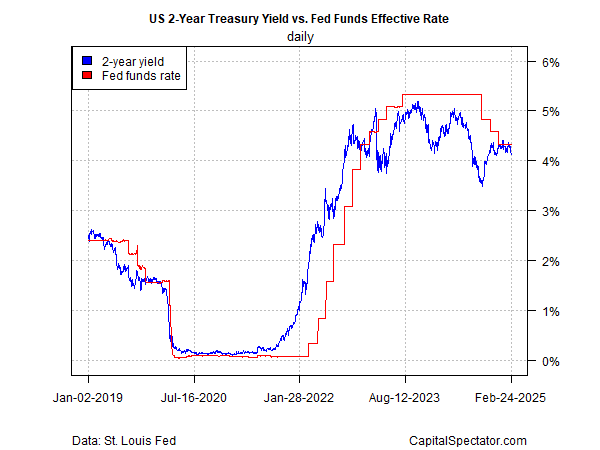

The policy-sensitive US 2-year Treasury yield seems to agree that policy is, for now, more or less approprate. This key rate, which is considered a benchmark for tracking expectations of future Fed decisions, fell to 4.18% yesterday (Feb. 24). The decline leaves the 2-year yield at its lowest close since December.

The recent slide in the 2-year yield also means the rate is again trading decisively below the median effective Fed funds rate, which implies the market is again starting to price in a relatively dovish outlook for Fed policy.

A simple model to assess the current profile of Fed policy, based on consumer inflation and unemployment, suggests that a modestly tight stance prevails, as of January.

The question is whether the Fed believes its current policy posture is appropriate going forward? A reality check is due on Friday, when the government publishes PCE inflation data for January. In contrast with last month’s “sticky” inflation report for CPI, economists expect a tamer round of numbers on Friday.

But January is already ancient history at a time of fast-moving policy shifts emanating from the White House. The challenge for the Fed is that the impact from tariffs and DOGE decisions will start to emerge within a few months while monetary policy still works with long and variable lags.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report

Fed Policy has been tracking the Taylor Rule since August 2023 or so. This is another indicator that policy is on target for now.

Forest,

I’m not so sure I agree. First, there are many flavors of the Taylor Rule so I’d be cautious on generalizing. Second, take a look at the comparisons here via the Atlanta Fed, which shows quite a bit of variability: https://www.atlantafed.org/cqer/research/taylor-rule?utm_medium=social-media&utm_source=twitter-atlantafed&utm_campaign=taylor-rule-utility&linkId=746015368