US economic activity slowed in January, according to the Chicago Fed National Activity Index. Two of the index’s four broad categories decreased from December, and one category made a negative contribution in January.

The mass layoffs of federal workers isn’t expected to shock the US economy, predicts Stephanie Roth, chief economist at Wolfe Research. “It’s not going to tip the economy into recession by itself.” But some analysts think otherwise. “We are starting to worry about the downside risks to the economy and markets from: 1) the impact of DOGE layoffs and contract cuts on jobless claims and 2) persistently elevated policy uncertainty weighing on capex spending decisions and hiring decisions,” writes Torsten Slok, chief economist at Apollo Global Management.

President Trump on Monday said tariffs on Canada and Mexico “will go forward” next week. “The tariffs are going forward on time, on schedule.”

Texas manufacturing activity fell in February, according to the Dallas Fed’s survey of business executives. The production index, a key measure of state manufacturing conditions, posted a sharply lower reading.

Home Depot, a belwether for the US economy, reported better-than-expected earnings for its fiscal fourth quarter. The home improvement retailer also posted positive comparable sales after eight straight quarters of declines.

The Federal Reserve is expected to “strongly and systematically” respond to changes in inflation and the labor market, according to research published on Monday by the San Francisco Fed: “The current perceived responsiveness to inflation is particularly high relative to past responsiveness. Furthermore, the perceived importance of employment as a driver of future policy interest rates has strengthened since 2024.”

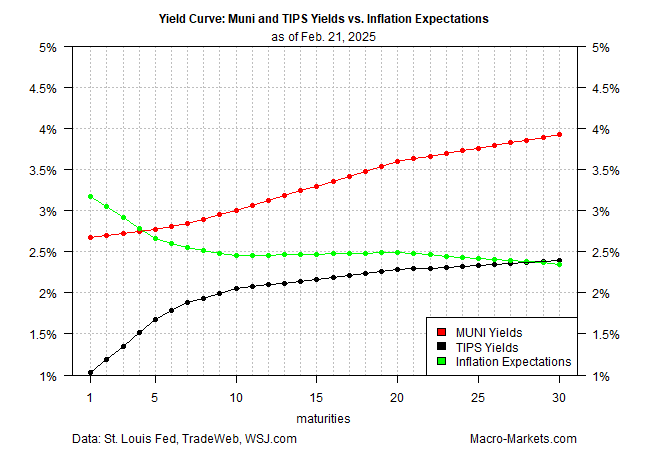

Muni yields look compelling relative to real rates available with inflation-indexed Treasuries, advises a note published by TMC Research, a unit of The Milwaukee Co., a wealth manager. “The recent rise in muni yields, combined with a decline over the past month in real yields, potentially creates new opportunities for investors looking for tax-advantaged bond holdings.”