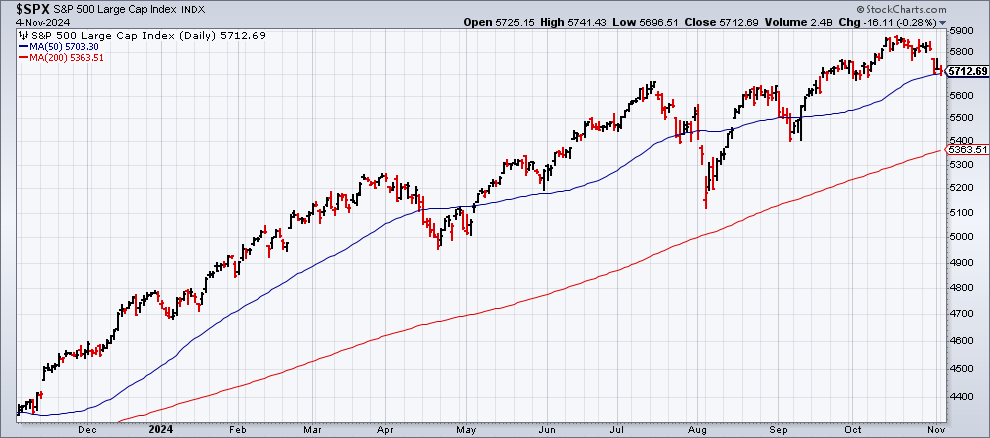

Can the stock market predict the election? For those who like to think so, the “Presidential Predictor” is cited. Advocates say this indicator has correctly forecast 21 of the past 24 elections, including Joe Biden’s win in 2020. The current reading points to a win for the Democratic Party and Kamala Harris. The forecast is based on whether the S&P 500 Index has incresed in the three months before the election, which signals the incumbent party will stay in office. On that basis, the market’s rise over the trailing 3-month window is telling, or so it seems. But since the market tends to rise generally, there’s plenty of room for doubt. “There is no simple, or complicated, economic model that predicts perfectly whether the incumbent’s party will win a presidential election,” says Jay Ritter, professor of finance at University of Florida’s Warrington College of Business. “When it comes to presidential elections, I would say that the stock market has about the same forecasting ability: better than nothing, but not a whole lot better.”

Federal Reserve is still expected to cut interest rates on Thursday, according to Fed funds futures. The market is pricing in a near certainty for a 1/4-point cut in the target to a 4.50%-to-4.75% range.

China’s services sector expanded at a faster rate in October, based on survey data via Caixin China General Services PMI. The index rose to 52.0 last month, up from 50.3 in September. A reading above the neutral 50 mark indicates growth. Another robust increase in export orders was a key driver in the pickup in growth.

Boeing strike ends as machinists union accepts the company’s latest offer. The strike, which started started Sep. 13, was reportedly the costiest in the US in over 25 years.

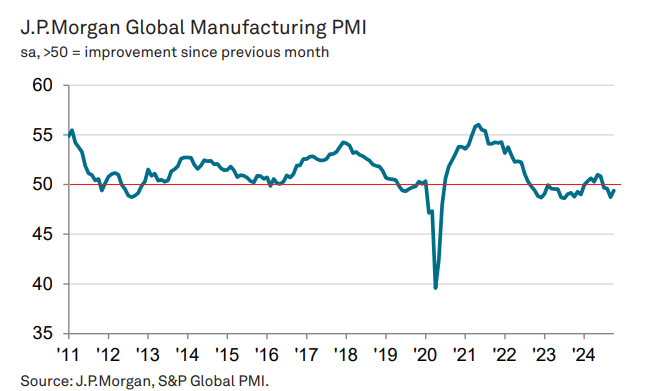

The global manufacturing downturn continued in October, according to PMI survey data. The J.P.Morgan Global Manufacturing PMI ticked up to 49.4, but the reading marks the fourth straight month below the neutral 50 mark.