US housing prices rose to another all-time high in July, based on the S&P CoreLogic Case-Shiller Index, which rose 5% year over year. The July increase marks the 14th consecutive month of a record high for the National Index component. “Overall, the indices continue to grow at a rate that exceeds long-run averages after accounting for inflation,” says Brian Luke, an analyst at S&P Dow Jones Indices.

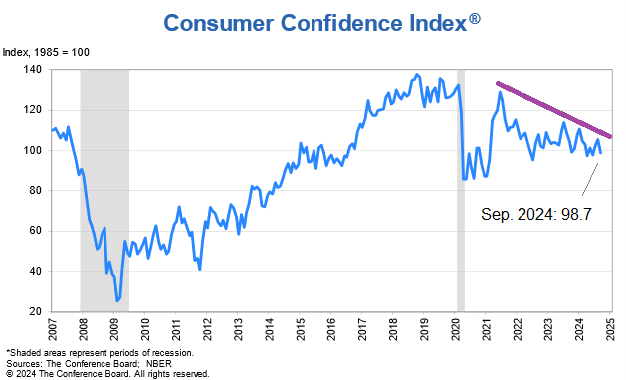

US Consumer Confidence Index fell to a 3-month low in September. The decline highlights an ongoing slide in the index over the past two years. “September’s decline was the largest since August 2021 and all five components of the Index deteriorated,” notes Dana Peterson, chief economist at The Conference Board. “Consumers’ assessments of current business conditions turned negative while views of the current labor market situation softened further.”

A strike next week by dockworkers across the US East and Gulf coasts is likely, says Griff Lynch, CEO of the Georgia Ports Authority. “We should probably expect there to be a work stoppage and we shouldn’t get surprised if there is one. “The question is: How long?”

The Economist reports that a possible port strike is already affecting the US: “Even if the strike is called off before October 1st, ‘it is too late,’ says Peter Tirschwell of S&P. Ports, carriers, retailers, warehouses and rail companies have been preparing for months for a possible shutdown. Shipments have been diverted to the west coast. Ports on both coasts and the Gulf are seeing higher volumes than usual because shippers are trying to get in as much holiday merchandise as possible before a strike.”

Rising debt levels in developed nations threaten macro stability, warn economists, the World Economic Forum reports: “High levels of debt are already having an impact on stability around the world. In Kenya, for instance, deadly protests erupted this summer after the government attempted to raise taxes to mitigate a debt crisis that saw interest payments swell to absorb almost 60% of total government revenues.”

A pair of key US economic reports (consumer inflation and payrolls for September) are expected to deliver relatively upbeat news next month, according to estimates by TMC Research. The one-year trend forecasts, if correct, will be among the last major economic updates before the US election on Nov. 5.

World economy is “turning a corner,” advises the Organization for Economic Cooperation and Development (OECD). The group projects that lower interest rates and rebounding real wages are supporting a modest improvement in expectations for global economic for 2024 and 2025. “With robust growth in trade, improvements in real incomes and a more accommodative monetary policy in many economies, the Outlook projects global growth persevering at 3.2% in 2024 and 2025, after 3.1% in 2023.”