* Biden convenes national security team amid fears of Iran attack on Israel

* US economy is starting to look “pre-recessionary”: Krugman

* Will the Fed announce an emergency rate cut? Unlikely, predict analysts, history

* ISM Services Index rebounds in July, showing key US sector strengthening

* Global economic growth eases for second month in July via PMI survey data

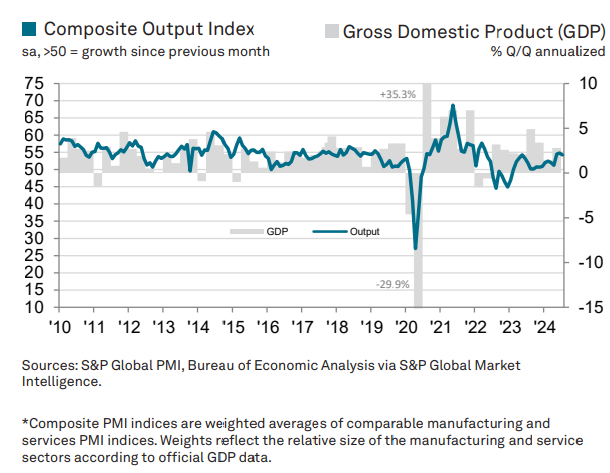

* US output expands “solidly” in July via Composite PMI Index, a GDP proxy:

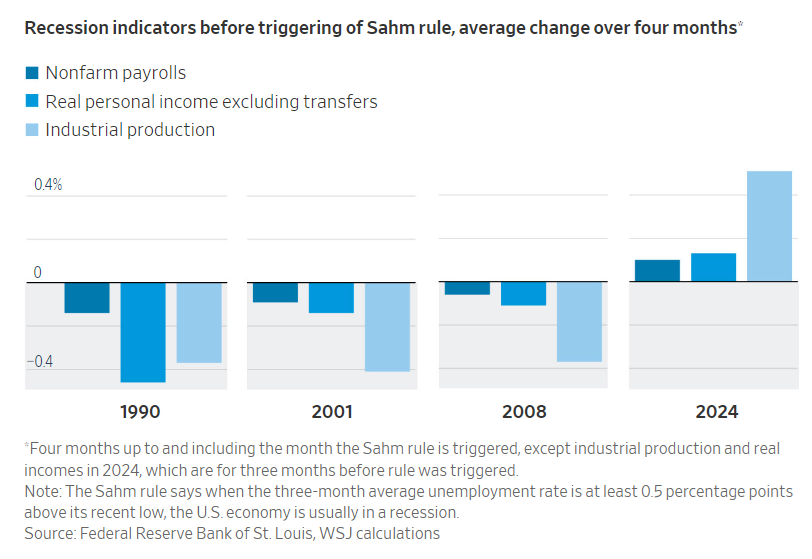

Has a US recession started? Several key indicators suggest otherwise, notes The Wall Street Journal. Non-farm payrolls, real personal income and industrial production are still posting a growth bias in the latest comparisons — in contrast with downside comparisons in previous downturns.

This WSJ analysis is egregiously cherry-picked. They left out real retail sales. Two out of three of the measures the WSJ did pick are lagging indicators. And, the WSJ picked the triggering of the Sahm Rule as the evaluation date – not the beginning of a recession. This analysis is so flawed that the only explanation is that there was an agenda. It is spin.

Forest,

Fair points, but as the broader range of indicators I discuss in my article suggest, the case that the US isn’t currently in recession (or that one is imminent) still looks persuasive. Tomorrow, however, is another day.

–JP