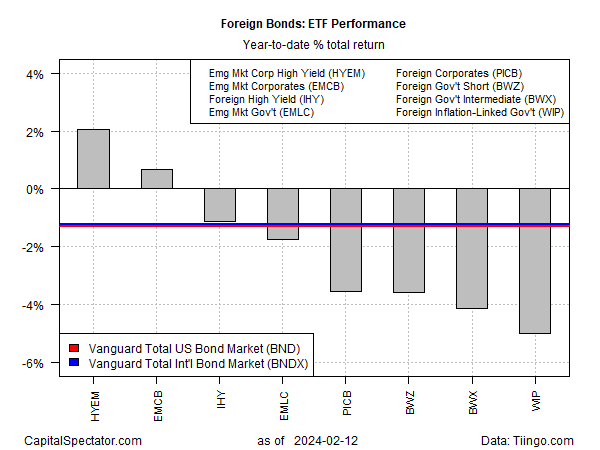

Much of the global bond market is struggling this year, with a conspicuous exception: below-investment-grade bonds issued by companies in emerging markets. Based on year-to-date results through Monday’s close (Feb. 12), this slice of global fixed income is outperforming and delivering a rare bit of strength in an otherwise lackluster field, based on a set of ETF proxies.

VanEck Emerging Markets High Yield Bond ETF (HYEM) is up 2.1% so far in 2024. The gain extends a solid 8.2% rise in 2023, offering one of the few sources of persistent profits over the past year-plus within the global bond space. In second place this year with a fractional 0.6% rise: WisdomTree Emerging Markets Corp Bond ETF (EMCB), which skews more toward investment-grade credits and governments issued in emerging markets. But as HYEM’s leading performance this year reminds, allocation to higher risk in foreign fixed income continues to pay off this year for global bond allocation.

Notably, the rest of the field is underwater so far in 2024. Echoing the slide in US bonds this year, negative results dominate. The deepest cut: inflation-indexed government bonds ex-US via SPDR FTSE International Government Inflation-Protected Bond ETF (WIP), which is down 5.0% so far this year.

Part of the allure for EM corporates is a relative lack of supply, reports Bloomberg:

Prices are jumping due to a dearth of EM corporate bonds in secondary trading. There’s been fewer issuances than expected, unlike sales of sovereign bonds that saw the most active January in three years. Companies are under little pressure to raise dollar debt as refinancing needs have moderated and other fundraising avenues, such as local-currency debt, open up. Some companies are returning capital to bondholders by buying back their debt.

Relatively attracting yields are another factor. HYEM, for example, has a 6.2% trailing yield for the past 12 months, according to Morningstar.com. That’s more than double the US investment-grade bond equivalent via Vanguard Total Bond Market ETF (BND). Although future yields are uncertain when buying bond funds (as opposed to locking in rates by purchasing individual bond securities), the yield premium in EM hasn’t gone unnoticed.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno