There’s no shortage of troubling developments around the world, but markets are still inclined to embrace a risk-on bias. There are exceptions, of course, but from several big-picture angles the trends continue to skew positive, based on a set of ETF pairs that serve as risk proxies through Monday’s close (Jan. 29).

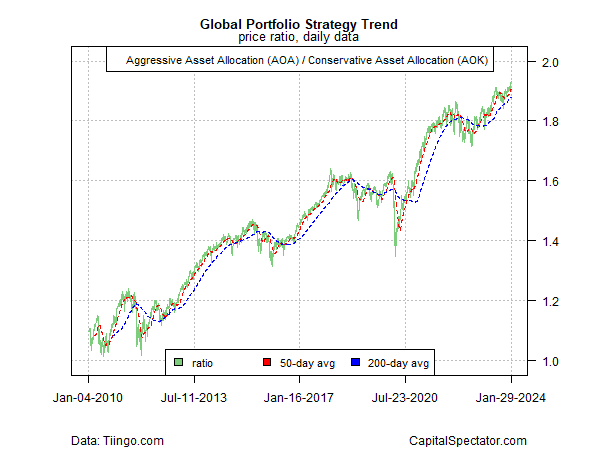

The risk-on bias was conspicuous at the start of January and the profile rolls on through today. Consider, for example, the ratio for an aggressive global asset allocation portfolio (AOA) vs. its conservative counterpart (AOK). This measure of the global risk appetite closed yesterday at a new record high, suggesting that investors have yet to turn cautious despite widening Middle East conflict that potentially could disrupt energy markets and is already creating turmoil for global shipping that moves through the region.

A similar risk-on profile prevails in the US equity market, based on US stocks (SPY) vs. a low-volatility subset (USMV). This benchmark for risk appetite in American shares has rebounded in recent weeks and is close to a record high.

Meanwhile, the relative performance of semi-conductor stocks (SMH), a business-cycle proxy, last week surged to a record high relative to US equities overall (SPY) before a modest pullback/consolidation through Monday’s close.

Another sign of the crowd’s appetite for risk: Housing stocks (XHB) continue to recover, as shown by the recent testing of a nine-year year relative to the broad US stock market (SPY).

A key downside outlier is the bond market. Although the Federal Reserve is expected to start cutting interest rates, perhaps as early as March, the risk appetite in fixed-income remains cautious at best. Indeed, measuring this appetite via medium-term Treasuries (IEF) vs. short-term governments (SHY) continues to reflect a risk-off bias, albeit one that’s may be in the early stages of a rebound.

Markets aren’t immune from global risks, but for now the so-called wisdom of the crowd continues to look through current events. Markets have “gotten used to trouble in geopolitics” in recent years, observes Beat Wittmann, partner at Porta Advisors. In an interview with CNBC today, he predicts that the US election in November will be “pretty irrelevant” for markets and that stocks remain the “asset class of choice.”

Two key risk factors lurking on the global stage don’t look threatening, at least not yet, Wittman reasons. “Will the trouble in the Middle East be a transmission into higher energy prices, or the war in Eastern Europe? Not really, if you look at how energy prices have developed.” Meanwhile, the recent turmoil in international trade routes, although it creates problems, has yet to reach a critical level and from the perspective of markets “that’s all digestible.”

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report