* Iran explosion adds to Middle East tensions

* Fed officials expect rate cuts in 2024: Fed minutes for December, but…

* Fed officials also said rates could remain high ‘for some time’

* US manufacturing slowed in December, ending ‘Lousy’ Year: ISM Mfg Index

* China services sector growth picks up in December

* Atlanta Fed’s nowcast model estimates US growth at moderate 2.5% for Q4

* US job openings continued easing in November:

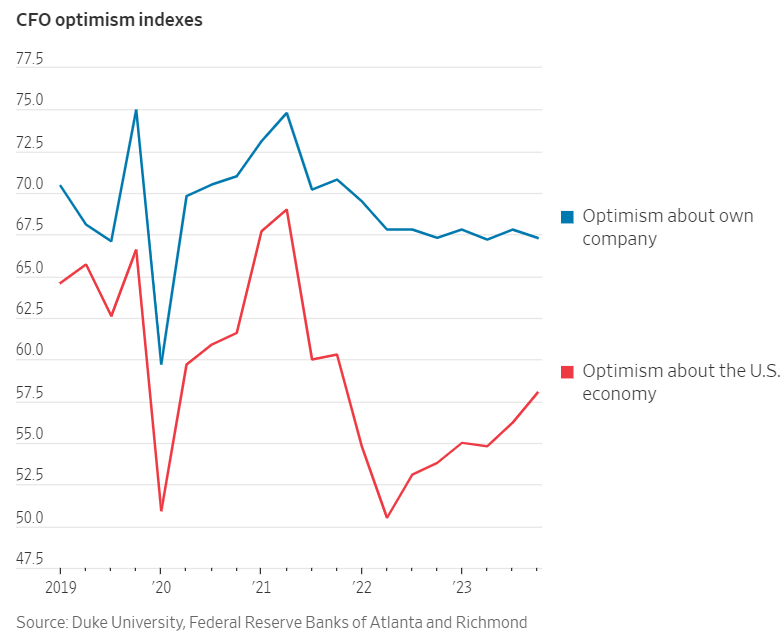

US companies don’t appear inclined to fire employees, which will provide support for labor market, reports The Wall Street Journal: “Economists have been lowering their recession odds lately, and so are American companies, to judge from recent earnings calls. In the fourth quarter, 239 transcripts of earnings calls included the word “recession” at least once, according to FactSet. This was the fewest since the first quarter of 2022, when the Fed had only recently begun its series of rate hikes, and well below 790 registered in the fourth quarter of 2022.” The Journal also notes: “A survey-based index compiled by Duke University and the Federal Reserve Banks of Atlanta and Richmond shows that CFOs’ optimism about the U.S. economy fell sharply in 2022 and only recently started showing signs of recovery. But their optimism about their own companies didn’t take much of a hit.”