US economic growth remains on track to slow in the fourth quarter, but today’s revised analysis still supports a “soft landing” outlook that will keep output strong enough sidestep an NBER-defined recession.

Next month’s official Q4 GDP release from the Bureau of Economic Analysis is expected to report the economy expanded by 1.2%, based on the median for a set of estimates compiled by CapitalSpectator.com. The modest nowcast marks a sharp deceleration from Q3’s red-hot 5.2% increase.

Today’s revised Q4 nowcast also reflects a decline from the previous 2.0% estimate for the current quarter, published on Nov. 28. The soft-landing outlook, although facing stronger headwinds in today’s update, remains intact. The question is whether the current estimate holds up in the weeks ahead?

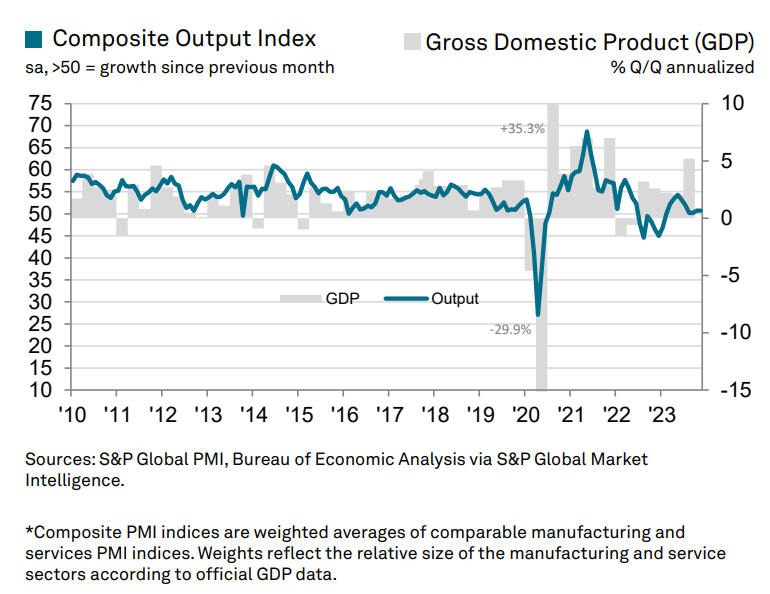

This week’s update of the US Composite PMI, a survey-based proxy for GDP, leaves room for managing expectations down. The index for November is 50.7, slightly above the neutral 50 mark that separates growth from contraction – a “marginal expansion”, reports S&P Global, which publishes the data.

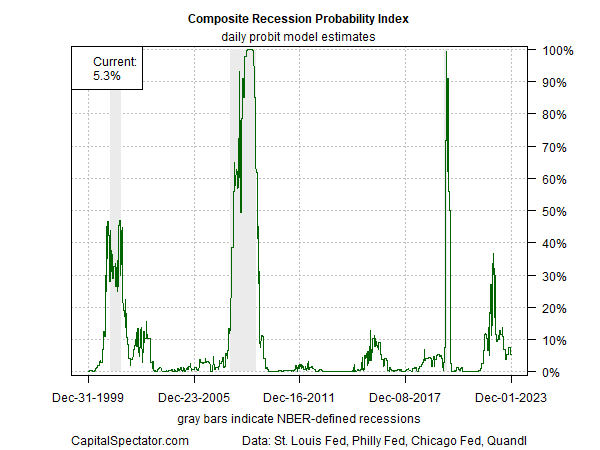

Looking at the US macro trend through another lens suggests that modest growth will prevail. As reported on CapitalSpectator.com earlier this week, “The latest weekly update of The US Business Cycle Risk Report continues to reflect low recession risk (through Dec. 1). The newsletter’s main indicator – Composite Recession Probability Index (CRPI) – estimates a roughly 5% probability that an NBER-defined downturn is in progress. (For details on the methodology, see the sample edition of the newsletter here.)”

With more than a month to go before the initial estimate of Q4 GDP data is published, the possibility of weaker incoming data could change the calculus. By some accounts, the change has already arrived and a recession is unescapable.

“Recession probably began in October,” advises Bloomberg Economics. The call looks premature in terms of a high-confidence estimate for an NBER-defined recession event, although the risk of contraction can’t be dismissed, given the sharp deceleration in the Q4 GDP nowcast.

The next several weeks will likely be crucial for deciding if Bloomberg’s recession call is accurate. Meantime, the numbers still look skewed in favor of modest growth through January, based on CapitalSpectator.com’s analytics, which draw on a wide variety of economic and financial indicators.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report