* Oil chokepoint–Strait of Hormuz–in focus as Israel-Hamas conflict persists

* Crypto king Sam Bankman-Fried found guilty of fraud in FTX collapse

* Global manufacturing activity contracts for fifth straight month in October

* Bullish stock market sentiment drops for third week to lowest level since May

* US jobless claims, while still low, rise for sixth week

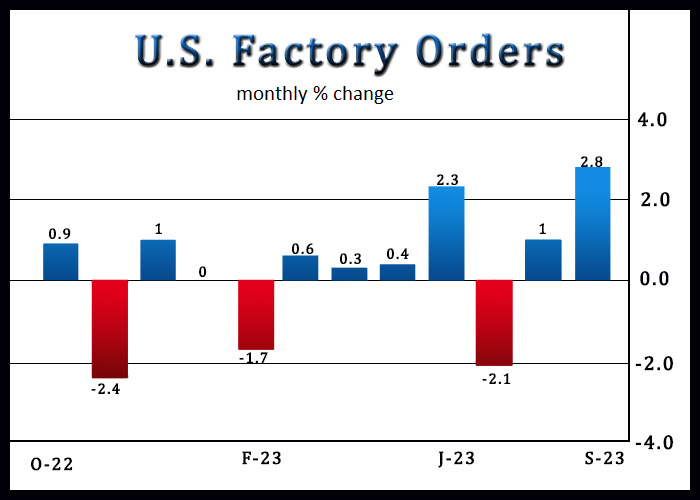

* US factory orders rose sharply in September, well ahead of expectations:

US 10-year Treasury yield fell for a third day on Thursday (Nov. 2), dropping to a three-week low as expectations strengthen that Federal Reserve is done with raising interest rates. Fed funds futures are currently pricing in an estimated 80% probability that the central bank will leave rates unchanged at the next monetary policy meeting on Dec. 13. Nonetheless, some analysts advise that yields will remain higher for longer. “We think 5.5 per cent long-term 10-year yields in the US is the level that seems consistent with the macro backdrop in the next five years,” says Jean Boivin, head of the BlackRock Investment Institute and a former deputy governor of the Bank of Canada. “It’s also consistent with the compensation for risks that bond investors should require to invest in long-term bonds.”