* The Israel-Gaza war threatens to re-ignite conflicts across the Middle East

* China announces more stimulus to aid struggling economy

* Central banks ‘100% dead wrong’ on economic forecasts: JPMorgan’s Dimon

* US orders AI-chip exports to China to halt immediately

* Bitcoin surges ahead of expected launch of BlackRock bitcoin ETF

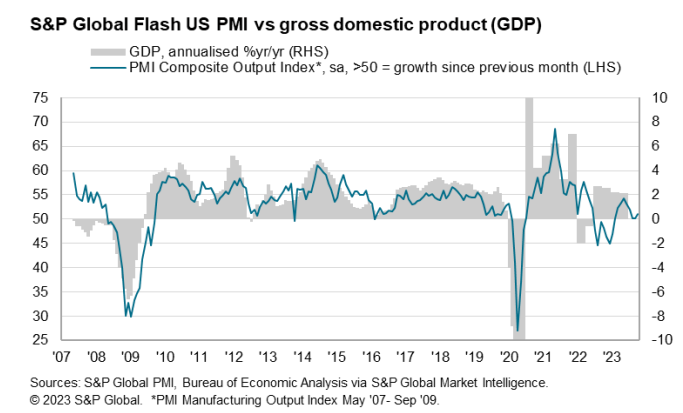

* US Composite PMI (GDP proxy) rises, suggests higher odds of soft landing:

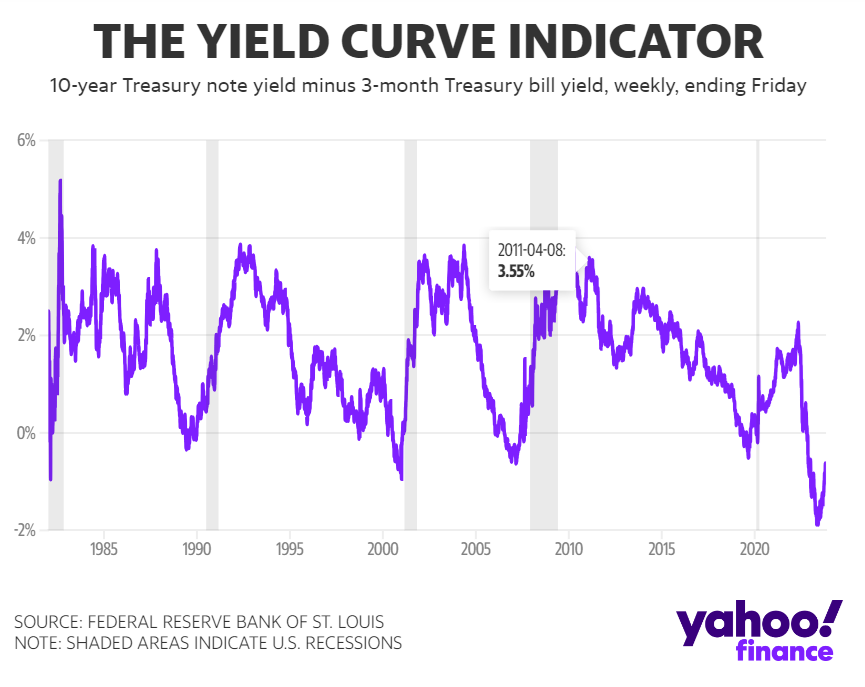

The US economic expansion has yet to satisfy the recession forecast that was triggered a year ago when the Treasury yield curve inverted, but economist Campbell Harvey, a professor at Duke, says “I’ve become a bit more pessimistic since August.” He advises that “[monetary tightening from the Fed] operates with a lag and we just don’t see it right now.” He points to the spread between the 10-year yield less 3-month bills and it’s flawless record of predicting recessions since World War II. The arrival of downturns vary, but as Yahoo Finance points out: “The past four recessions occurred when the spread between the two yields narrowed and came close to reverting back to normal. That is what is happening now.”