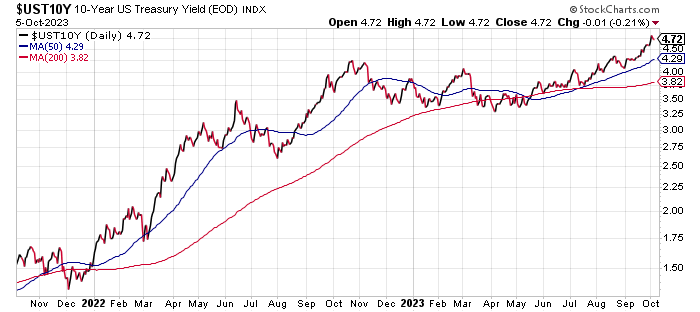

* The slide in Treasury bond prices since 2020 is among the worst on record

* China’s economy faces years of headwinds due to real estate crisis

* More than 40% of small firms report difficulty in finding workers

* Oil prices set for biggest weekly decline in 6 months

* Average US mortgage rate rises to 23-year high: 7.49%

* Exxon Mobil near deal in acquiring shale driller Pioneer

* Narrowing US trade gap in August expected to support Q3 GDP growth

* US jobless claims remain low, suggesting labor market strength in near term:

If the recent rise in Treasury yields persists, the Federal Reserve may no longer need to raise interest rates, says San Francisco Fed President Mary Daly. “The bond market has tightened quite considerably over about 36 basis points since we met in September.” Speaking at the Economic Club of New York on Thursday (Oct. 5), she advises: “That is equivalent to about a rate hike. So then the need to do tightening additionally is not there.”