Current yields continue to show signs of peaking, based on a broad review of the major asset classes via a set of proxy ETFs. In each of our periodic updates of yields so far this year, the numbers reflect a decline from the previous review.

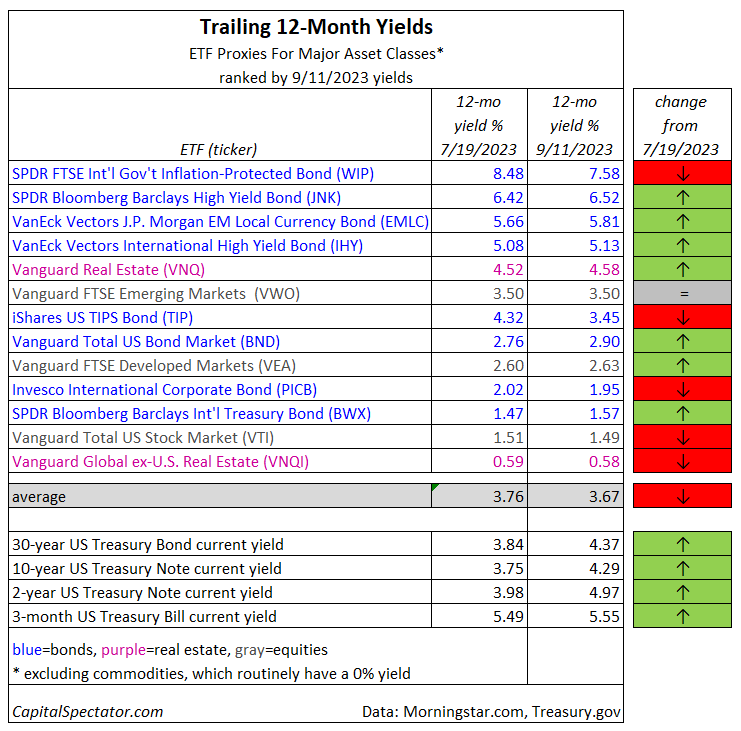

Today’s figures extend the trend. The average yield for global risk assets dipped again to 3.67% (as of Sep. 11, 2023) from the previous update’s 3.76% (July 19, 2023). The peak for our irregular updates was 4.50% (Dec. 19, 2022).

While the trailing 12-month yield (according to Morningstar.com) for risk assets has been falling in 2023, US Treasury yields continue to rise. The 10-year Note, for instance, ticked up to 4.29%, well above the portfolio average in the table above.

Cherry picking markets, however, still reflects unusually high trailing yields. The top payout rate in the table above is still SPDR FTSE Int’l Gov’t Inflation-Protected Bond (WIP), which boasts a trailing 12-month yield of 7.58%, Morningstar reports. Although that’s persistently eased this year, it’s still head and shoulders over the rest of the field. At the opposite extreme: real estate ex-US (VNQI), which is yield a thin 0.58%.

Payout rates in financial markets may be sliding, but there’s still opportunity for potentially capturing relatively high yields. But here comes the standard caveat: Trailing payout yields for stocks and other risk assets listed above aren’t guaranteed (in contrast with current yields from government bonds for buy-and-hold investors). Keep in mind, too, the ever-present possibility that whatever you earn in yields via ETFs fund could be wiped out, and more, with lower share prices.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report