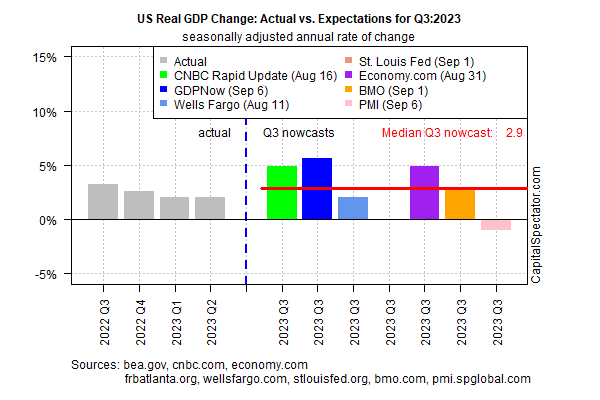

Stronger headwinds may be brewing for the US economic outlook, but next month’s third-quarter GDP report looks set to post a moderately firmer growth rate, based on the median estimate via several sources compiled by CapitalSpectator.com.

Today’s revised data shows US output for the July-through-September period will rise 2.9% for GDP’s seasonally adjusted annualized change. This median nowcast reflects a solid improvement over the 2.1% increase reported by the government for Q2.

Today’s update of the median nowcast also marks a rise from the previous 2.4% estimate for Q3 published on Aug. 25.

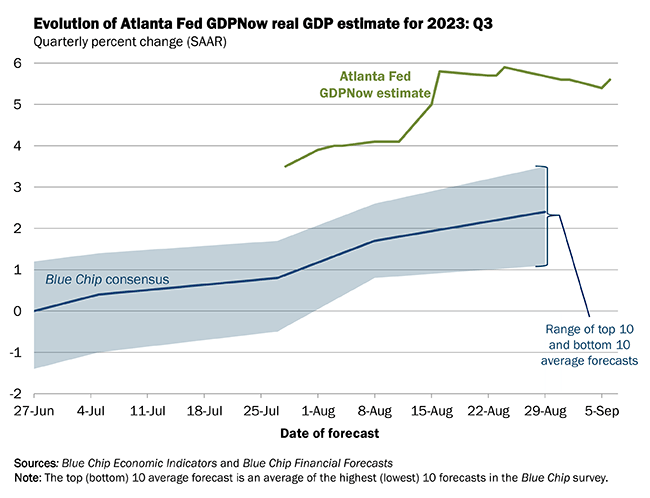

Among the component numbers that define the median there’s a wide variety of nowcasts, a range that speaks to the general level of uncertainty that prevails for economic analysis at the moment. At the high end of the Q3 figures is the Atlanta Fed’s red-hot GDPNow model’s 5.9% estimate (as of Sep. 6).

On flip side is yesterday’s revised data for the US Composite PMI, a survey-based proxy for GDP. The August reading reflects a near-flat performance for US economic activity. “The slowdown in growth stemmed from a weaker service sector expansion and a renewed decrease in manufacturing output,” reports S&P Global, which publishes the PMI numbers. Running the PMI history through a regression model and using the August data point as a predictor indicates that Q3 GDP will slide 1.0%.

As usual, it’s challenging in real time to say which nowcast is most accurate and so the median, if history is a guide, offers the best guesstimate. On that basis, it’s reasonable to assume that US economic output will continue to post moderate growth in next month’s initial GDP estimate from the Bureau of Economic Analysis, scheduled for release on Oct. 26.

To be fair, there are several risk factors that could derail the relatively upbeat outlook for Q3 data between now and the Q3 report. But until there’s a material deterioration in the median estimate, the odds still look skewed for moderate growth in the July-through-September period.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report