* Treasury Secretary Yellen will visit China this week

* Is the US payrolls survey overestimating the labor market’s strength?

* Automakers pushed into lithium mining to compete in electric vehicle market

* China factory activity remains sluggish in June via PMI survey data

* Does AI signal the start of fourth industrial revolution–or is it a bubble?

* Apple becomes world’s first $3 trillion company based on market cap

* Will the US avoid a recession this year? Economists are still debating

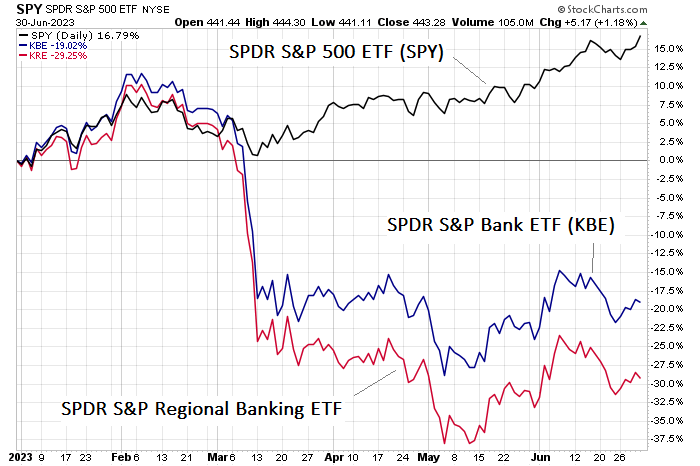

* US stock market begins trading this week at 14-month high:

US bank stocks continue to trade near the lowest prices following the March crisis that was triggered by the collapse of Silicon Valley Bank. “While the valuations and pullback in the shares make banks attractive on the surface, the dual concern about a recession later in the year and the looming downtown office real estate glut provide pause,” writes Bill Stone, chief investment officer of The Glenview Trust Company. “Generally, the view is that the mega banks are safe and might benefit from the deposit flight from and worries about the smaller banks. In addition, large banks have less exposure to the potential looming issues with office real estate loans. Continuing to hold the large banks or perhaps adding selectively makes sense, but it seems too early for a large wager on the banks, and investors should tread very carefully in smaller banks.”