* Federal Reserve raises its target rate 1/4-point to 5.0%-to-5.25% range

* Policy-sensitive 2-year Treasury slides after Fed hike

* PacWest Bancorp shares tumble; latest US bank to seek financial lifeline

* China manufacturing business conditions “moderate slightly in April”

* Eurozone economy in April grows at “strongest pace since May 2022”

* ISM Services Index ticks up in April, reflecting modest growth

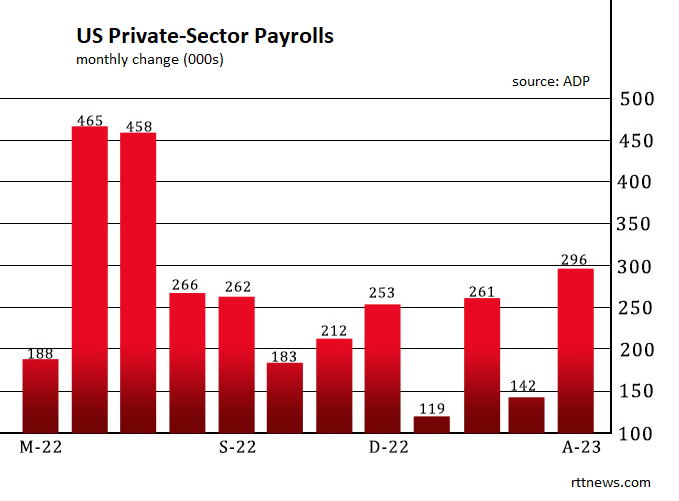

* US hiring at companies rebounds sharply in April via ADP data:

Jobs data suggest labor market is cooling, based on lower job openings and worker quits and an increase layoff rate in March, the Labor Dept. reported on Wednesday. “Two words: unambiguous cooldown,” says Nick Bunker, director of North American economic research at job site Indeed. He adds: “If you’re looking at the current temperature of the labor market, it’s still strong, still hot.” Daniel Zhao, lead economist at job site Glassdoor, tweets: “The most concerning figure from the JOLTS report is the jump in layoffs & discharges, rising to 1,805,000 in March, near the pre-pandemic level after spending much of the last 2 years well below, amidst a historically hot job market.”