* IMF predicts interest rates will fall to pre-Covid levels

* Analysts say corporate America is in an earnings recession

* Consumer inflation expectations rise for first time in months

* Consumers say credit is getting harder to come by, Fed survey shows

* Falling money supplies signal elevated recession risk for US, UK and Eurozone

* China consumer inflation slows to softest pace since September 2021

* Eurozone retail sales fell in February, reversing January’s gain

* Bitcoin rallies above $30k for first time since June

* Will bank lending slow after recent turmoil in the industry?

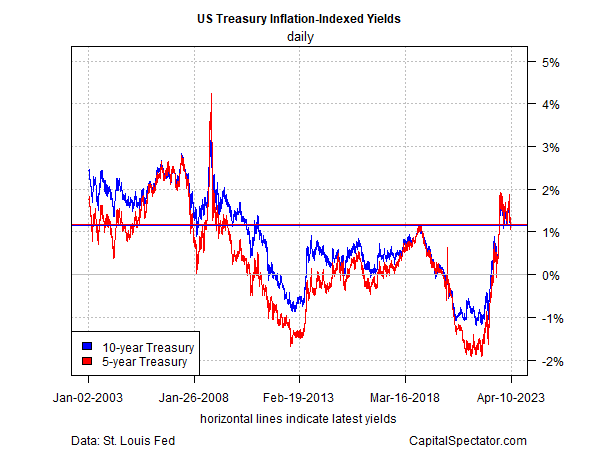

* US real Treasury yields hold above 1%–highest since 2010:

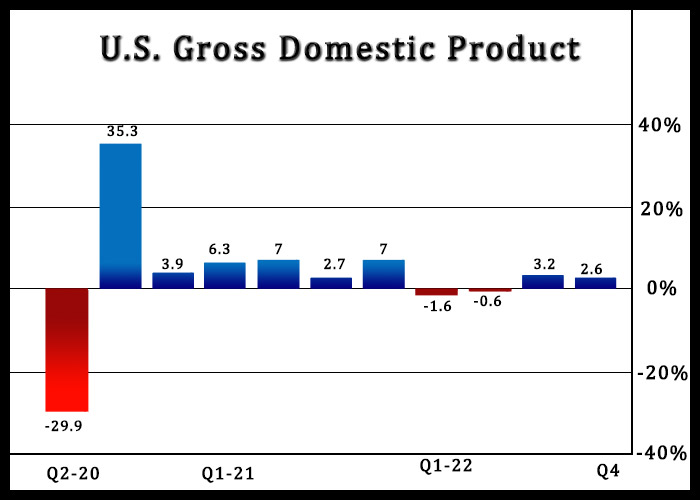

The risk of long but shallow recession is elevated for US, predicts Mizuho Securities. The trigger: a “deep and long credit crunch contraction,” the broker advises. “The Fed always tightens until something breaks,” explains Steven Ricchiuto, US chief economist at Mizuho Securities USA, in a research note. “The key question markets have to answer right now is which type of credit dislocation the economy is dealing with following the regional bank debacle.” He observes: “Let’s be clear: every postwar recession has been triggered by the Fed.”