* Saudi Arabia and other major oil producers announce oil output cut

* Analysts predict oil at $100 per barrel after OPEC’s surprise output cut

* China factory growth stalled in March, according to PMI survey

* Eurozone factory output rises slightly in March via PMI survey data

* Credit risk for bonds matters again in the wake of banking turmoil

* “Dr. Doom” remains as gloomy as ever on the economic outlook

* Lake Tulare’s return in California will raise prices for variety of farm goods

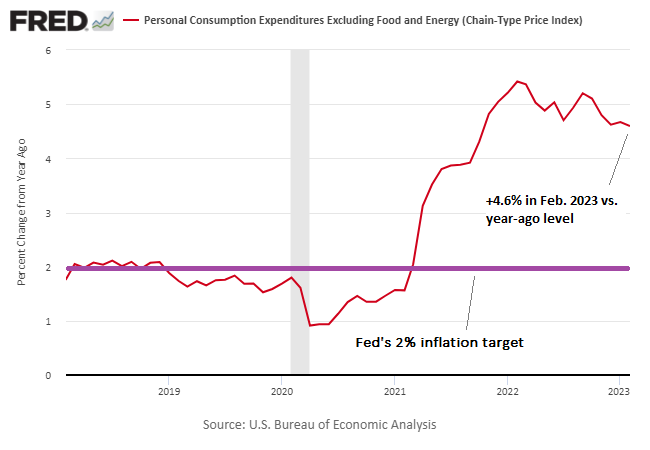

* Fed’s preferred inflation metric eases but remains high:

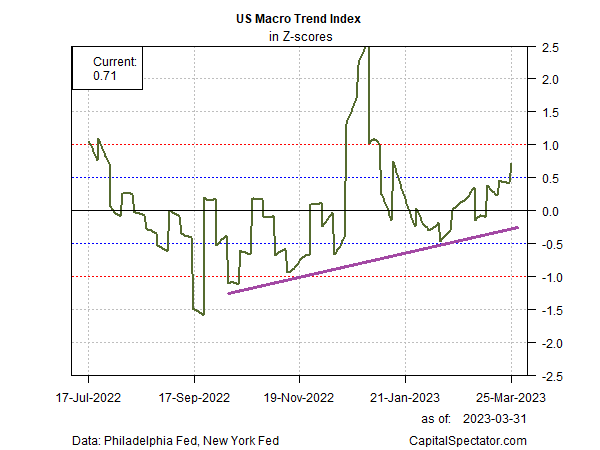

US economic activity appears to be firming up, based on the US Macro Trend Index (MTI), a metric developed by CapitalSpectator.com that combines the New York Fed’s Weekly Economic Index and the Philly Fed’s ADS Index. MTI measures the real-time strength of the directional bias for US economic activity. The index has been steadily rising this year and is currently at the highest reading since January 6.