US consumer inflation continues to ease, but less so than expected in January. Yesterday’s update suggests that the Federal Reserve will see the latest numbers as new sign that pricing pressure isn’t cooling fast enough. In turn, the case may have strengthened at the central bank for keeping interest rates higher for longer.

One central bank official on Tuesday advised that lifting rates “for a longer period than previously anticipated” may be on the table. “When inflation repeatedly comes in higher than the forecasts, as it did last year, or when the jobs report comes in with hundreds of thousands more jobs than anyone expected, as happened a couple weeks ago, it is hard to have confidence in any outlook,” says Dallas Fed President Lorie Logan, a voting member on the rate-setting Federal Open Market Committee in 2023.

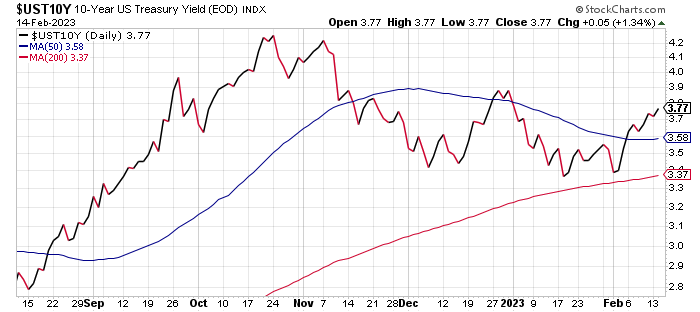

Despite conditions that appear to offer support for a higher US 10-year Treasury yield, the benchmark rate remains moderately below its recent peak. The 10-year yield ticked up to 3.77% on Tuesday (Feb. 14), roughly a half percentage point below October’s high.

Meanwhile, CapitalSpectator.com’s fair-value model for the 10-year yield continues to reflect a lower estimate vs. the market yield.

A lower fair-value estimate has prevailed in recent months, offering useful guidance for expecting a limited upside bias for the 10-year rate. In November, for example, when the 10-year market rate was trending higher, the fair-value model suggested that “macro headwinds are pushing back on higher yields in a stronger degree.” Since then, the 10-year rate has more or less traded in a range below its October peak.

The question is whether incoming inflation data will change the calculus and convince the Fed to strengthen its hawkish bias? That could push the 10-year rate higher as the market factors in a more restrictive monetary policy. Alternatively, the market could price in softer economic conditions due to the Fed’s course correction, which may inspire new investment flows into Treasuries as a safe-haven trade, thereby putting more downside pressure on bond yields.

Whatever lies ahead, the current fair-value estimate of the 10-year rate, which reflects economic and market data through January, suggests relatively low odds for a significant, sustained rise in the benchmark rate. Let’s see if the still-evolving macro profile for February suggests otherwise.

Learn To Use R For Portfolio Analysis

Quantitative Investment Portfolio Analytics In R:

An Introduction To R For Modeling Portfolio Risk and Return

By James Picerno