* Russia launches new attacks on Ukraine, which lauds West’s plan to send tanks

* Hiring surge by small firms complicates Fed’s plans to cool inflation

* Sen. Manchin seeks delay in new tax credits for electric vehicles

* Will a gain in today’s Q4 GDP report minimize recession risk?

* Consumer prices remain high despite softer inflation data

* Investors eye layoffs at investment banks as recession indicator

* Does Google antitrust investigation threaten its dominance in search business?

* Smartphone shipments plunge in Q4, largest decline on record

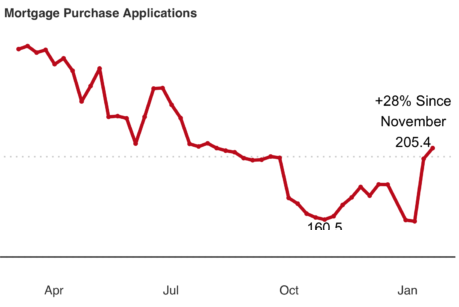

* US housing demand showing signs of rebounding, advises Redfin:

Gold edges up to 9-month high as central banks lift purchases of the precious metal to fastest rate in half a century.

Is the 60/40 portfolio dead? “In the long run, whether bonds will do their job within the 60/40 depends on what happens to inflation on a structural level,” says Jurrien Timmer, director of global macro at Fidelity Investments. Wei Li, global chief investment strategist at BlackRock, notes: “Chances of a repeat of last year’s poor performance [for a 60/40 portfolio] are low,” adding: “We’re entering an era of higher market volatility. And that has implications on the 60/40 as well.”