* Bipartisan lawmakers prepare plan to defuse debt-ceiling crisis

* China’s reopening may boost global inflation

* Market-based gauges of inflation project rapid inflation slide in months ahead

* The first ETF celebrates its 30th birthday this week

* Banks set for deepest layoffs since the financial crisis

* The long and winding road to the US government’s $31 trillion pile of debt

* Big tech’s big reversal linked to mistaken bets on pandemic-fueled growth

* Fed’s Waller supports slowing next rate hike to 25 basis points

* US existing home sales fell again in December, lowest since November 2010:

The correlation between US stocks and bonds appears to be moving closer to a “normal” relationship lately — each market moving independently of the other — but it’s unclear if the trend shift is temporary or longer-lasting. “The correlation now has shifted back to a more traditional one, where stocks and bonds do not necessarily move together,” says Kathy Jones, chief fixed-income strategist at Charles Schwab, via MarketWatch.com. “It is good for the 60-40 portfolio because the point of that is to have diversification.” But Oliver Allen, a senior markets economist at Capital Economics, wonders if the recent positive correlation between stocks and bonds has longer to run. “That negative correlation between the returns from Treasuries and US equities stands in stark contrast to the strong positive correlation that prevailed over most of 2022,” The “shift in the US stock-bond correlation might be here to stay.”

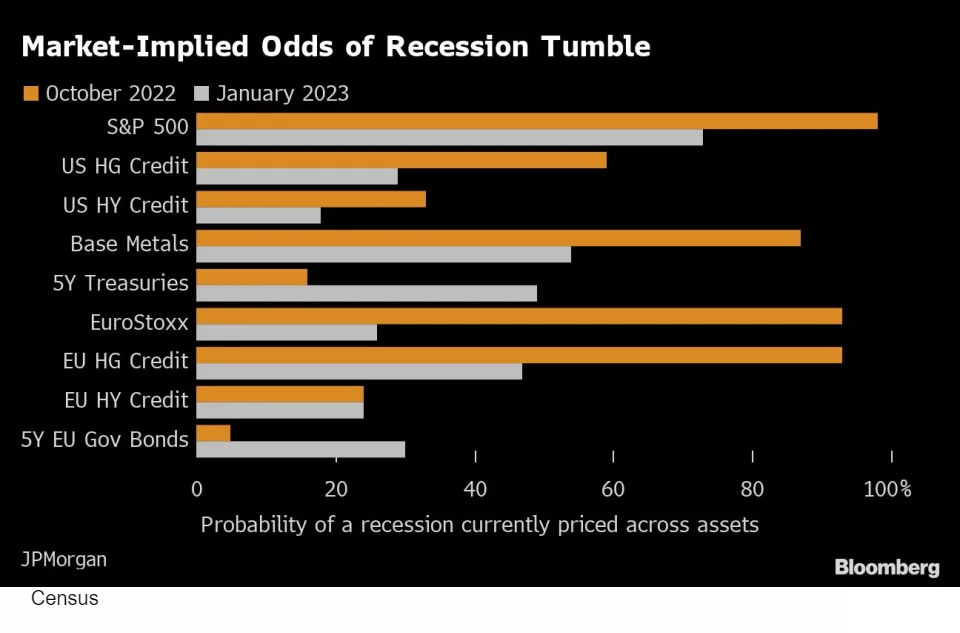

JP Morgan’s recession model, based on markets across several asset classes, estimates lower recession risk, Bloomberg reports. “According to the firm’s trading model, seven of nine asset classes from high-grade bonds to European stocks now show less than a 50% chance of a recession. That’s a big reversal from October when a contraction was effectively seen as a done deal across markets.” The estimates are “by comparing the pre-recession peaks of various classes and their troughs during the economic contraction.”