* Russia continues to attack Ukraine with drones, targeting energy facilities

* Europe generates record level of wind, solar power as Russian gas supply falls

* China economic outlook downgraded via Xi Jinping’s political agenda

* Strong US dollar is spreading economic pain around the world

* Solid earnings growth for Bank of America imply strong US consumer sector

* Microsoft announces job cuts, citing softer growth in revenue and sales

* Oil market eyes another possible release from Strategic Petroleum Reserve

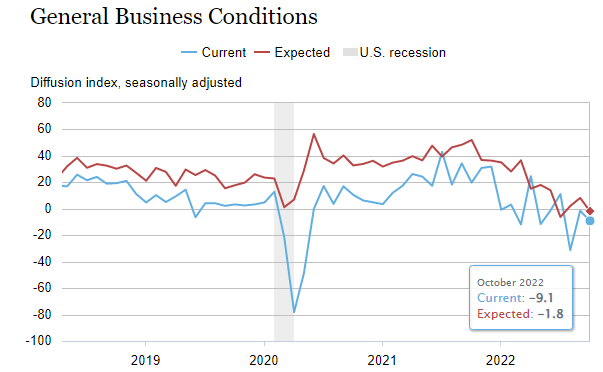

* NY Fed Mfg Index contracts for third straight month in October:

Natural gas costs for Americans will increase this winter, forecasts US Energy Information Administration. “We forecast that US households that primarily use natural gas for space heating will spend an average of $931 on heating this winter (October–March), which is 28% (or $206) more than last year,” EIA reports. “Natural gas is the primary heating fuel for 47% of U.S. homes, according to the U.S. Census Bureau’s 2021 American Community Survey.”

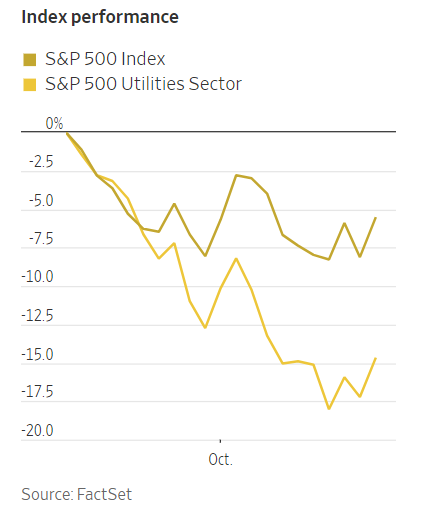

Rising interest rates take a toll on safe-haven utility stocks. “The 10-year is repricing everything. I’ve got something that’s even safer and yields even more,” says Kevin Barry, chief investment officer at Summit Financial, in terms of Treasurys vs. utility stocks. Stephanie Lang, chief investment officer at wealth management firm Homrich Berg, adds: “There was a big piling in there, and valuations have gotten too stretched.”