* Chin’s Xi and Russia’s Putin hold summit

* US rail strike averted after tentative deal is reached

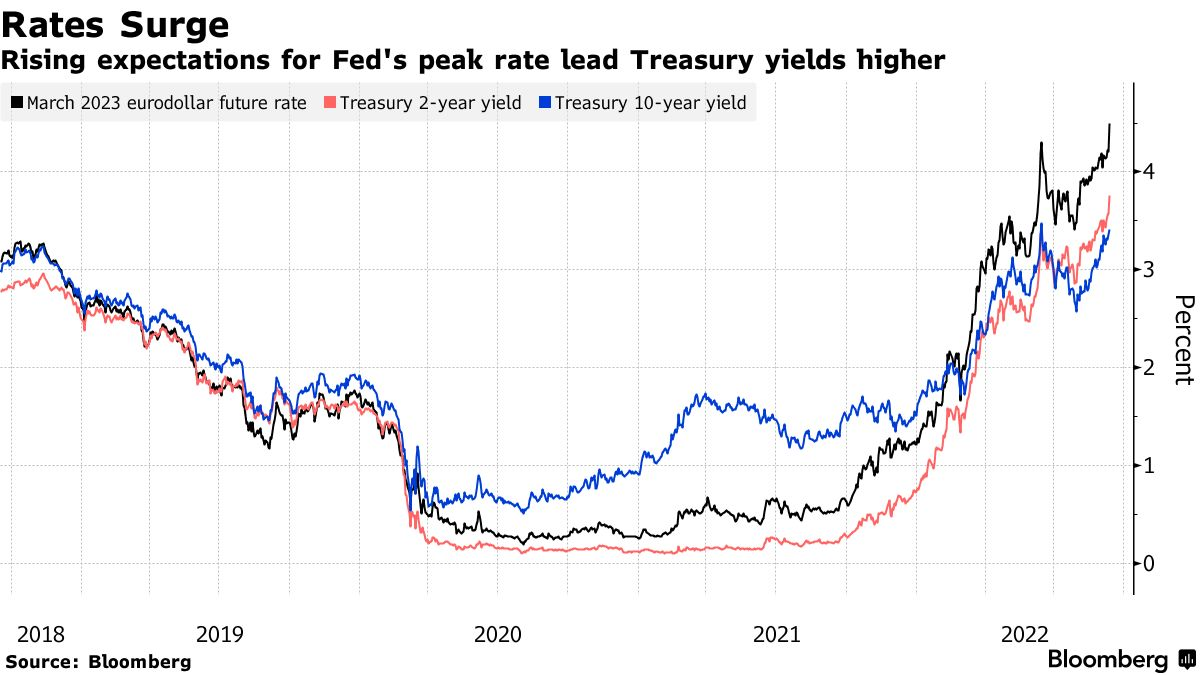

* Policy-sensitive 2-year Treasury yield briefly tops 3.8%

* Mortgage rates top 8% for first time since 2008

* Demand for mortgages fall sharply as interest rates rise

* Higher rent prices are a key driver of inflation

* Wholesale inflation in US slips in August to still-high 8.7%

* California sues Amazon, alleging antitrust violations

* Business inflation expectations fell to 9-month low via Atlanta Fed survey:

The Federal Reserve’s challenge with taming inflation appears increasingly linked to economic momentum. “Inflation currently has a very large underlying component that is grounded in a red-hot labor market,” says Jason Furman, an economist at Harvard University. “And then, in any given month, you may get more inflation because of bad luck, like gas going up, or less because of good luck, like gas going down.”

Don’t discount deflation just yet, advises a Wall Street investor and two high-profile supporters. CNBC reports: “Cathie Wood, Wall Street’s most vocal proponent of deflation, is getting a few high-profile supporters even as price pressures continued to surprise to the upside. Jeffrey Gundlach and Elon Musk recently joined Wood’s camp in calling for a decline for prices, expressing worries that the Federal Reserve might go too far. The so-called bond king warned of deflation risk on Tuesday, urging investors to buy long-term Treasuries. Meanwhile, the Tesla CEO called falling commodity prices ‘neither subtle nor secret” and tweeted to his 100 million followers that ‘a major Fed rate hike risks deflation.’ ”

Bridgewater’s Ray Dalio estimates where interest rates are headed and predicts the trouble it will bring to the economy. “It looks like interest rates will have to rise a lot (toward the higher end of the 4.5% to 6% range),” the founder of Bridgewater Associates writes this week. “This will bring private sector credit growth down, which will bring private sector spending and, hence, the economy down with it.”