Slow growth, rising interest rates, high inflation and a sundry list of other risk factors threaten to push the US economy into recession at some point in the near term. Or so a chorus of analysts and economists have been warning. It’s short-sighted to dismiss those forecasts, but the data published to date continue to show that US economic activity continues to defy the macro pessimists, at least for now.

Here’s a quick look at several business-cycle indicators from various sources, reflecting different methodologies and assumptions about what triggers recession. The one thing they share in common: the economic expansion continues and appears set to persist for the immediate future.

Let’s start with CapitalSpectator.com’s proprietary US business-cycle indexes: Economic Trend Index (ETI) and Economic Momentum Index (EMI). For details on the designs, see this sample issue of The US Business Cycle Risk Report. The main takeaway: ETI and EMI have been sliding for months and point to slow and slowing growth but have yet to reach their tipping points that mark the start of an NBER-defined recession. Given how close these indexes are to those tipping points, however, it’s clear that another leg down in US economic activity is likely to trigger a new contraction. In other words, the next several months will be critical for deciding if the US succumbs to the forces of macro darkness.

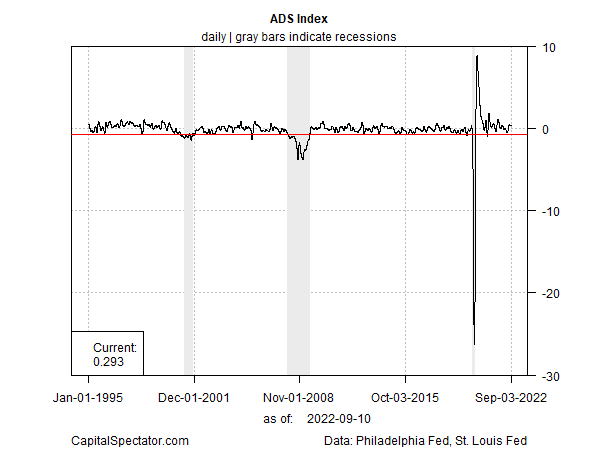

The Philly Fed’s ADS Index, a multi-factor business-cycle benchmark, paints a moderately brighter profile of current US economic conditions. The caveat: this index is more volatile than ETI and EMI and so the latest upbeat reading could quickly turn ugly. In any case, at the moment ADS indicates low recession risk and modestly above-average growth (relatively to the historical record).

The NY Fed’s Weekly Economic Index also points to slowing growth but the odds of recession are still low, based on data through Sep. 3.

The Sahm Indicator also indicates low recession indicator through August:

Ditto for the latest recession estimate for so-called smoothed recession probabilities, albeit through July:

The Chicago Fed National Activity Index (3-month average) also confirms that a recession didn’t start in July.

Finally, here’s an econometric forecast of ETI and EMI through October (for details on the methodology, see this sample of The US Business Cycle Risk Report). The forward estimates show that both indexes are set to tick lower next month, inching closer to their respective tipping points that signal recession. The implied message: Q4 is shaping up to be the acid test for the US economy’s resilience, or lack thereof.

How is recession risk evolving? Monitor the outlook with a subscription to:

The US Business Cycle Risk Report