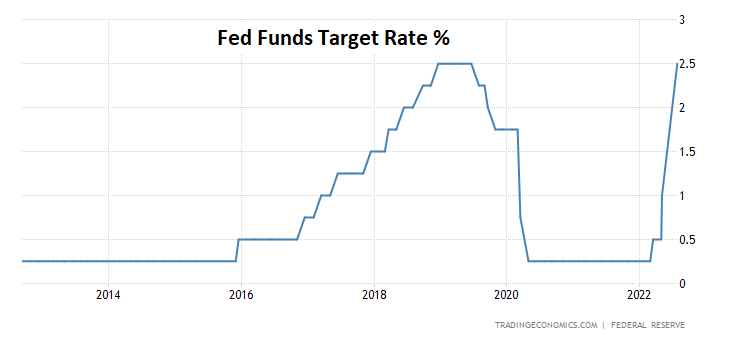

* Markets are focused on today’s speech from Fed Chairman Powell @ 10am ET

* Putin orders increase in Russian military troops

* Russia halts a natural gas shipment to Asia over payment issues

* UK energy bills for households expected to rise 80% in October

* Midwest drought is causing more trouble for grain markets

* Will a housing recession lower house prices? Maybe not, says economist

* US consumers borrow at record levels to buy cars

* US Q2 GDP loss is softer than initially estimated

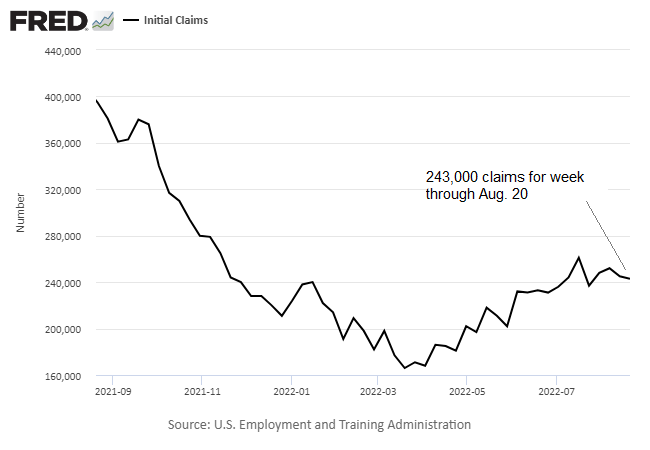

* US jobless claims fall for 2nd week, highlighting tight labor market:

Should the Fed continue hiking interest rates? Yes, but another 100-basis-points increase will suffice, says Wharton business school professor Jeremy Siegel. “I think we only need 100 basis points more,” he tells CNBC. “The market thinks it’s going to be a little more — 125, 130 basis points more. My feeling is we won’t need that much because of what I see as a slowdown.”