* More rate hikes needed despite slowing inflation, say Fed officials

* Traders downgrade expectations for a 75-basis-points rate hike in September

* Atlanta Fed’s GDPNow model raises Q3 nowcast to solid +2.5%

* US average gasoline prices below $4 a gallon for first time in months

* Ford CEO doesn’t see lower costs for electric vehicle batteries on horizon

* Hot inflation could boost Social Security payments by $1700 on average in 2023

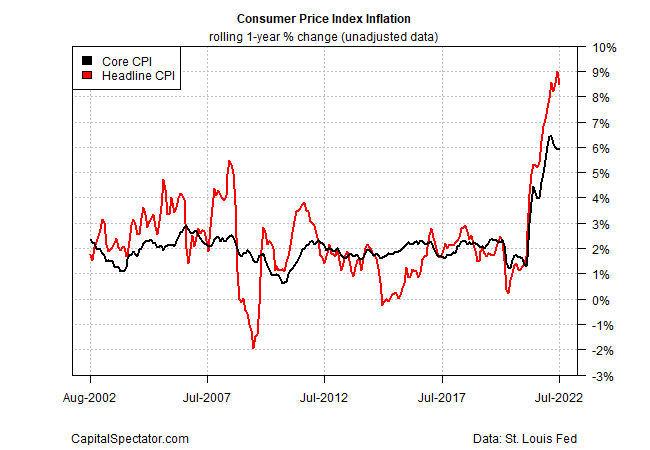

* July data for US consumer price data suggests inflation may have peaked:

What’s the worst-case scenario for Europe’s energy crisis? Jason Bordoff, an energy policy expert and former adviser to Barack Obama lays out a scenario: “I think you would see Russia continue to restrict gas exports and maybe cut them off completely to Europe — and a very cold winter. I think a combination of those two things would mean sky-high energy prices. But there’s a lot of other sources of uncertainty and risk. It’s not just high prices. There comes a certain point where there’s just not enough molecules to do all the work that gas needs to do. And governments will have to ration energy supplies and decide what’s important.” He also sees a possibility that countries in Europe begin to “turn against each other in terms of whether energy is allowed to flow across borders. If you’re a country like Germany — which not only consumes a lot of gas but is also a transit country through which gas flows to other European countries — why would you allow gas to flow through your country when you’re shutting down your energy-intensive industries, while your economy is suffering? I think we could start to see governments saying, “Well, we’re going to restrict exports. We’re going to keep our energy at home.” Everyone starts to just look out for themselves, which I think would be exactly what Putin would hope for.”

Businesses’ year-ahead inflation expectations fall to 3.5% on average in August, reports the Atlanta Fed.

Is it time to tame expectations for predicting a US recession? “The whole recession narrative really needs to be put on a shelf for now,” says Aneta Markowska, chief economist at Jefferies. “I think it’s going to be shifting to a stronger-for-longer narrative, which is really supported by a reversal in inflation.”